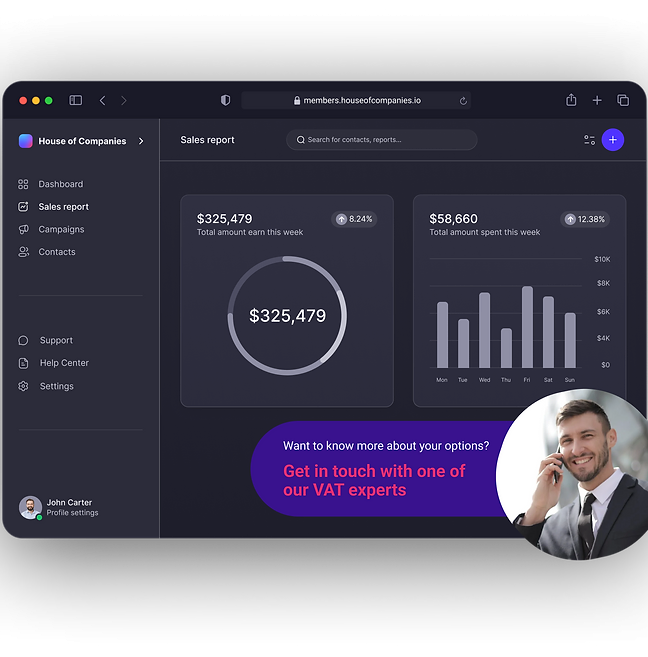

At House of Companies, we understand the importance of efficient bookkeeping for your business in Latvia. Our services are designed to simplify your bookkeeping processes, ensuring accuracy and compliance with Latvian regulations.

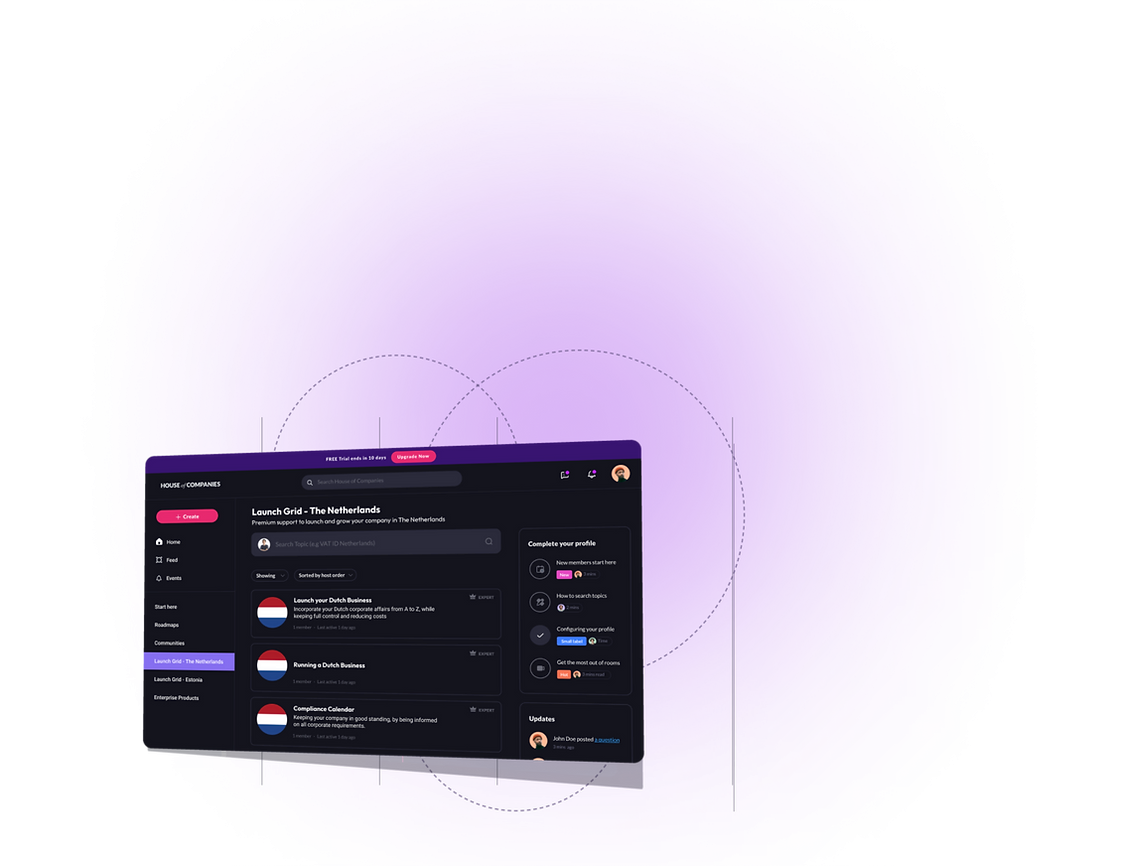

Our expert team is ready to help you streamline your bookkeeping tasks. With our automated solutions, you can focus on growing your business while we handle the financial details. House of Companies simplifies the procedure of submitting your data using a single source for all documents, data, and reports. You can track our progress and your profits in real-time!

"House of Companies has transformed our bookkeeping process. Their automated solutions are efficient and reliable, allowing us to focus on our core business activities."

Global Talent Recruiter

Global Talent Recruiter"My accountant in India drafts my VAT reports and submits the returns using the Entity Management system! It's been seamless."

Spice & Herbs Export

Spice & Herbs Export"The knowledge and support from House of Companies helped me feel more confident about managing my own tax filing, and it worked perfectly!"

IT firm

IT firmThe standard corporate tax rate in Latvia is 20%, applying to resident companies and non-resident establishments.

Taxable income includes worldwide profits, dividends, interest, royalties, and capital gains. Deductions are allowed for business expenses and depreciation.

Latvia offers tax incentives such as reduced rates for Special Economic Zones (SEZs), R&D expense deductions, and support for startups.

Companies must file annual tax returns by June 1st, make advance tax payments, and comply with transfer pricing regulations.

Our international tax advisers provide comprehensive support for your business in Latvia. From tax planning to compliance, we ensure that your business meets all local and international tax obligations. If you need help filing your tax return, House of Companies is here to help.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!