Latvia, strategically located in Northern Europe, offers a dynamic and growing business environment for entrepreneurs and investors looking to expand in the EU. As a member of the European Union, Latvia provides seamless access to the EU single market, making it an excellent location for businesses aiming to establish a foothold in Europe.

Block Chain (South Africa)

Non-Profit Organisation

Beauty Products Trading

Trucking & Logistics

Bol.com trader

Recruitment & Payrolling

Spice & Herbs Export

IT firm

Select the best legal structure for your company, whether it's a sole proprietorship, partnership, or limited liability company. We’ll guide you through the pros and cons of each option to ensure you start on solid ground.

choose a unique name, prepare key documents like articles of association, and register with the Latvian Register of Enterprises. A minimum share capital is recommended for added benefits.

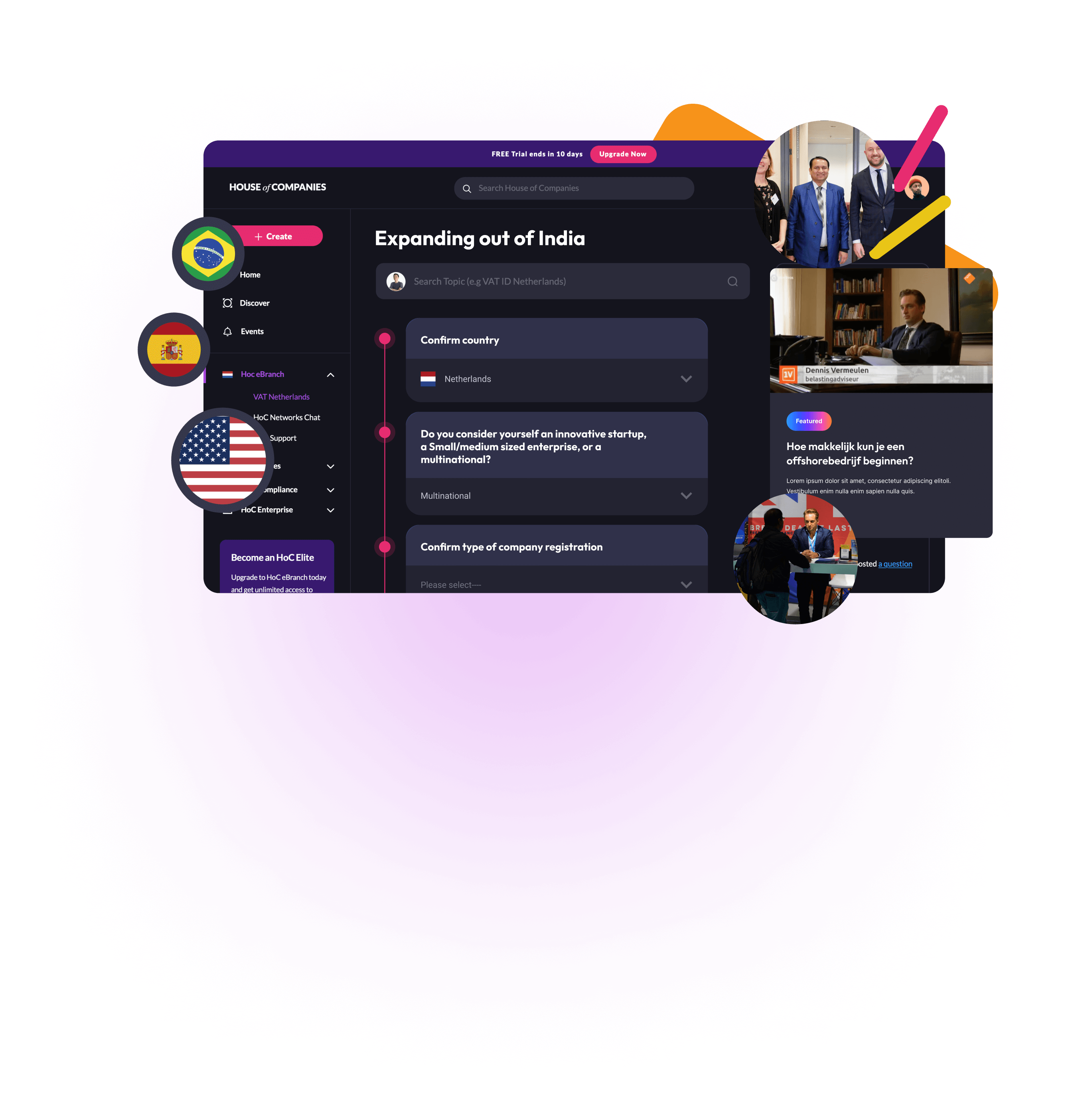

Research Latvia's economic landscape, including its strategic position between Western and Eastern markets. Familiarize yourself with the country's business-friendly policies, such as the 0% tax on reinvested profits. Analyze industry trends and consumer behavior specific to your sector. Consider engaging local experts or consultants to gain deeper insights into the nuances of doing business in Latvia.

If you're planning to set up or manage a business in Latvia, you may need a business visa or residence permit depending on your nationality and the duration of your stay.

DEAL TYPE: 100% online EXPIRY: No expiry

DEAL TYPE: 100% online EXPIRY: No expiry

DEAL TYPE: 100% online EXPIRY: No expiry

DEAL TYPE: 100% online EXPIRY: No expiry

Wherever we can, we are committed to include the offers into our Launch Grid. Some countries, and some legal processes will not allow this for the time being.

We hope that in 10 years from now, our Launch Grid is fully autonomous and more Launch Control is needed

For foreign investors planning to set up their business in Latvia, choosing the appropriate legal entity is an essential step. Our expert entity management services simplify this process, assisting both EU and non-EU investors in understanding and complying with Latvia's business regulations. Whether you seek to protect your personal assets or ensure a smooth market entry, we provide personalized solutions to align with your specific business objectives.

The SIA is the most popular choice for foreign investors in Latvia, requiring at least one founder, articles of association, and registration with the Commercial Register. It offers limited liability for shareholders and allows for a flexible management structure. The minimum share capital is €2,800, with at least 50% needing to be paid before registration, making it a secure and accessible option for businesses of various sizes.

VAT registration in Latvia is mandatory when turnover exceeds €50,000 within 12 months, although businesses can register voluntarily below this threshold. VAT returns must be filed monthly or quarterly, depending on the company’s turnover. Latvia’s standard VAT rate is 21%, with reduced rates of 12% and 5% for specific goods and services. Ensuring proper compliance with VAT regulations is essential for smooth operations and avoiding penalties.

Establishing a branch office in Latvia is an excellent way for foreign companies to expand operations without creating a separate legal entity. Registration with the Commercial Register and the appointment of a local representative are mandatory. While the parent company is liable for the branch's obligations, the branch must comply with Latvian accounting and tax regulations, including filing annual financial reports.

Non-EU entrepreneurs with innovative business ideas can apply for a Latvian startup visa. Eligibility requires support from a qualified venture capital fund or accelerator, along with a strong business plan. Applicants must submit essential documents, such as a passport, proof of funds (minimum €4,000), health insurance, and a criminal record check. The process also includes attending an interview to discuss the business concept and its potential.

Creating a subsidiary in Latvia provides foreign companies with a separate legal entity, offering limited liability protection. The setup process is similar to registering an SIA, requiring registration with the Commercial Register and a minimum share capital. As a resident company, the subsidiary is subject to local taxes, but profits can be repatriated to the parent company, subject to withholding tax regulations.

Latvian law mandates strict compliance with its Accounting Law and Labor Law, making professional bookkeeping and payroll services crucial. Local accounting firms can assist with maintaining accurate records, preparing financial statements, and managing payroll processes. Using certified accountants and keeping records updated ensures compliance with tax authority requirements and helps avoid financial penalties.

Register a branch of your current LTD in >10 countries

Complete your residency application with our help

Get our help to submit your Corporate Tax Return

Find a Facilitator, Write a Deck or Plan, and Start your Application with our help.

When it comes to establishing and managing your business in Latvia, our comprehensive entity management services are the perfect choice for entrepreneurs worldwide, including those from non-EU countries. We combine local expertise, advanced automation, and tailored support to simplify the complexities of setting up and expanding in the Latvian market.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!