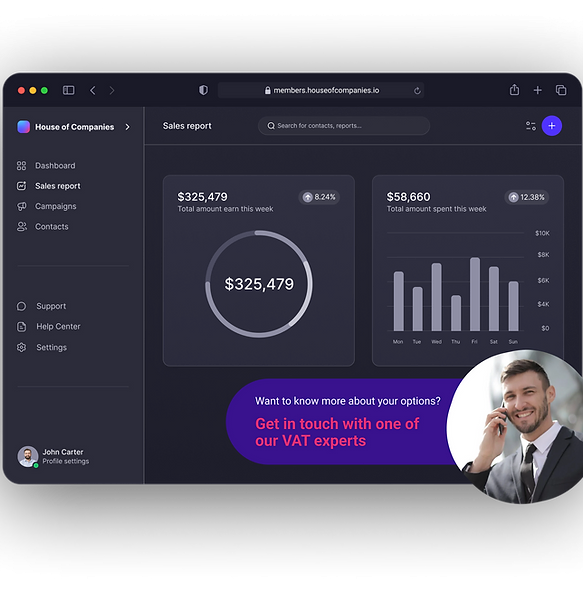

With our Entity Management platform, you can efficiently manage your corporate tax filings in Latvia, along with other essential business tasks, from a single control panel. Avoid the need for expensive tax lawyers or third-party services, and maintain full control over your filings. Whether you're working with your current accountant or handling it yourself, we offer the most cost-effective and streamlined solution to submit your corporate tax return.

Submitting your corporate tax returns in Latvia is now easier than ever with advanced online tax portals designed to simplify the process for global entrepreneurs. Our Entity Management platform offers a seamless solution for submitting corporate tax returns, ensuring effortless compliance. Take advantage of our Free Trial to experience the convenience and efficiency of our services.

Once your corporate tax return is filed successfully, continue using our Entity Management platform to manage and grow your business effectively. Let us handle your tax compliance so you can focus on scaling your company in Latvia.

"I started a company in Latvia, but the project never took off. I didn't want to pay over 1,500 EUR for filing a zero return. With Entity Management, I filed everything myself and saved money!"

James Franco

James Franco"My local accountant in Dubai drafted my UK tax report, and filing with the system worked fine. The simplicity of the process made a real difference!"

Sophia Martinez

Sophia Martinez"Entity Management's expertise gave me the confidence to get more involved in my own tax filing in Latvia. It worked perfectly!"

Liam Chen

Liam ChenWhile Entity Management is designed to handle the bulk of your tax filing needs, certain situations may require the expertise of a local tax specialist. In Latvia, a tax consultant may be needed for more complex tax matters or to navigate specific local tax regulations.

Our House of Companies team can support you in submitting your tax return in Latvia, whether you're providing us with your financial documents or starting from scratch. Our International Tax Officers are available to help with complex or personal tax issues, which may not be fully addressed by the Entity Management platform (though these capabilities are continuously expanding!).

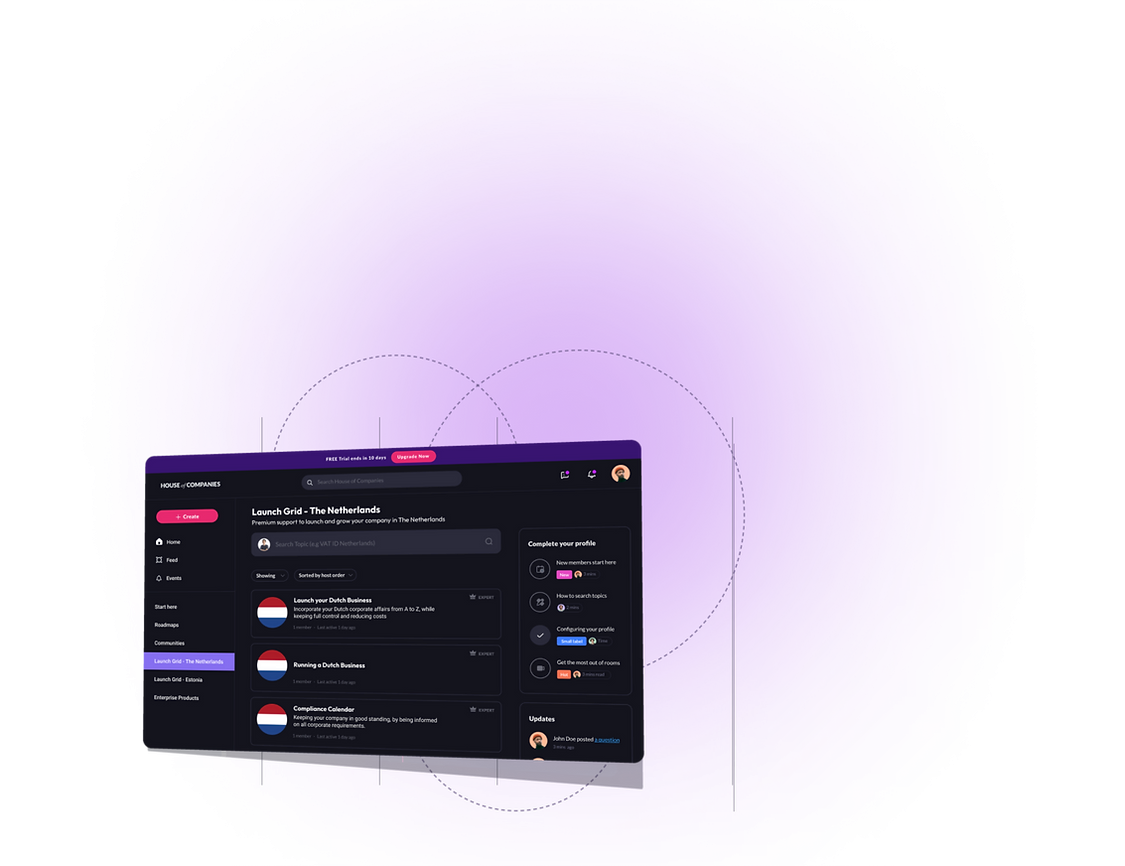

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!