We’re Here to Guide You! and provides bespoke consulting services, and a innovative Entity Portal from which you can register your Latvian business, and fully run it, without involving a lawyer or accountant!

The process of starting a Limited Liability Company (SIA) in Latvia has become more straightforward, thanks to services like The House of Companies and its expert entity management solutions. This guide provides a detailed overview of the SIA formation process in Latvia, covering essential legal requirements, regulations, and practical steps. Whether you’re a local entrepreneur or an international business owner, this resource will help you navigate the complexities of establishing your company in Latvia with confidence and ease.

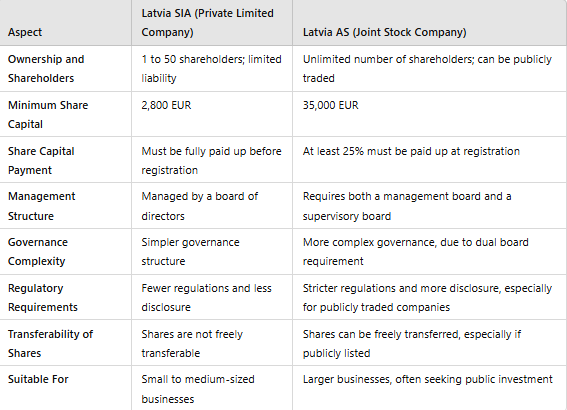

A Private Limited Company in Latvia, known as Sabiedrība ar ierobežotu atbildību (SIA), is one of the most popular business structures in the country. It is similar to a Limited Liability Company (LLC) in other jurisdictions. The SIA is governed by the Commercial Law of Latvia, which was adopted on April 13, 2000, and has undergone several amendments since then.

An SIA is characterized by its limited liability nature, meaning that shareholders are not personally liable for the company’s debts beyond their invested capital. This legal structure is particularly attractive for small to medium-sized businesses and foreign investors due to its flexibility and relatively simple management structure

Key features of an SIA include:

The legal framework for SIAs ensures a balance between protecting creditors’ interests and providing flexibility for business operations. This structure has made Latvia an attractive destination for both local and international entrepreneurs looking to establish a presence in the Baltic region.

Incorporating a Limited Liability Company (SIA) in Latvia is a straightforward process governed by the Commercial Law and overseen by the Register of Enterprises. The first step is reserving a unique company name, which must end with “SIA” or “sabiedrība ar ierobežotu atbildību.” Next, you prepare and notarize necessary documents, such as the Articles of Association, an application for registration, and confirmation of the legal address, along with a bank statement showing the share capital deposit.

After opening a temporary bank account and depositing the share capital, you submit all documents to the Register of Enterprises, along with the state fee. Registration typically takes 3 business days, with expedited services available. The company is automatically registered with the State Revenue Service for tax purposes, and a company seal is optional.

Finally, within 14 days, you must submit information about the company’s beneficial owners to the Register of Enterprises. The whole process generally takes 5-7 business days. Many entrepreneurs use legal services to ensure smooth processing and compliance.

Choosing an SIA (Sabiedrība ar ierobežotu atbildību) for your business in Latvia offers a range of benefits, making it a popular choice for both local and international entrepreneurs. One of the primary advantages is the limited liability protection, which ensures shareholders' personal assets are safeguarded, with liability confined to the amount of their investment. This makes it a secure option for managing business risks.

Additionally, the low minimum capital requirement of just €2,800 makes it accessible for startups and small businesses. The structure also offers flexibility in ownership, allowing for both single and multiple shareholders, with no restrictions on foreign ownership. This provides various options for business models and investment structures.

The SIA structure is easy to manage, particularly for companies with fewer than five shareholders, as a board of directors is not mandatory. This can simplify decision-making processes. Moreover, Latvia’s competitive corporate tax system, including a 0% tax rate on reinvested profits, is an attractive feature for businesses aiming to grow. With access to the EU single market, potential for expansion, and privacy benefits, the SIA structure offers a solid foundation for business success in Latvia.

The process of starting a Latvia SIA (Sabiedrība ar ierobežotu atbildību) is relatively efficient, reflecting the country’s commitment to fostering a business-friendly environment. The duration can vary depending on several factors, but generally, it takes between 3 to 10 business days from start to finish.

It’s important to note that these timelines assume that all documents are in order and there are no complications or requests for additional information from the authorities. Factors that could potentially extend the timeline include:

To ensure the smoothest and fastest process possible, many entrepreneurs choose to work with local legal professionals or company formation agents who are familiar with the nuances of Latvian business law and can navigate potential pitfalls efficiently.

In summary, while it’s possible to complete the SIA formation process in as little as 3-5 business days under optimal conditions, it’s prudent to allow for 7-10 business days to account for potential delays or unforeseen circumstances. This timeline still positions Latvia as one of the more efficient countries in the EU for company formation, contributing to its appeal as a business destination.

Changing the legal structure of a Latvia SIA (Sabiedrība ar ierobežotu atbildību) is a process that may be necessary as a company evolves, grows, or adapts to new business circumstances. The Commercial Law of Latvia provides several options for structural changes, each with its own procedures and implications.

It’s crucial to note that any significant change to an SIA’s structure may have tax implications and may require consultation with tax authorities. Additionally, certain changes may trigger the need for a mandatory audit.

The process of changing an SIA’s legal structure can be complex and time-consuming, often taking several months to complete, especially for more significant changes like mergers or transformations. It’s highly advisable to seek professional legal and financial advice to navigate these processes effectively and ensure compliance with all relevant laws and regulations.

In all cases, transparency and proper documentation are key. All major changes must be properly recorded, approved by the relevant parties (shareholders, board members), and registered with the appropriate authorities to ensure legal validity and continuity of the business operations.

Forming an SIA (Sabiedrība ar ierobežotu atbildību) in Latvia requires careful planning and attention to detail. This comprehensive checklist will help ensure you’ve covered all the essential steps in the formation process:

By following this checklist, you can ensure a smooth and compliant process for forming your SIA in Latvia. Remember that while this list covers the main aspects of company formation, specific requirements may vary depending on your particular business circumstances. It’s always advisable to consult with local legal and financial professionals to ensure full compliance with all relevant laws and regulations.

For global entrepreneurs looking to establish a presence in Latvia, setting up an SIA (Sabiedrība ar ierobežotu atbildību) can be a straightforward process when approached systematically. Here’s a streamlined guide tailored for international business owners:

This streamlined process allows global entrepreneurs to efficiently establish their SIA in Latvia, taking advantage of the country’s business-friendly environment and strategic location. However, it’s crucial to note that while this guide provides a general overview, specific requirements may vary based on your business type and circumstances. Consulting with local legal and financial experts is always recommended to ensure full compliance and smooth operation in the Latvian market.

Selecting a notary is an essential step in establishing an SIA in Latvia, as many required documents must be notarized. Notaries in Latvia are public officials appointed by the state and are responsible for certifying the authenticity of signatures, copies of documents, and the legal capacity of individuals. For SIA formation, they verify the identity of founders, certify signatures, and ensure the legality of the process.

To find a notary, you can use the Latvian Council of Sworn Notaries’ website or contact them directly. Notaries are available in major cities like Riga, and many speak English, which is beneficial for international entrepreneurs. It's important to choose a notary with experience in business formations, particularly someone familiar with international clients and commercial law. The notary will provide services such as notarizing company documents, certifying identification documents, and offering advice on legal requirements.

When visiting a notary, make sure to schedule an appointment in advance and bring all necessary documents, including valid identification and certified translations for any foreign-language documents. Notary fees are regulated by the state, though costs may vary depending on the type and number of documents. In some cases, remote notarization is available, making it easier for foreign entrepreneurs. Proper notarization ensures the legal validity of your company formation in Latvia.

The Flex SIA is an innovative version of the traditional SIA (Sabiedrība ar ierobežotu atbildību) in Latvia, designed to make company formation more accessible for entrepreneurs, especially startups and small businesses. This structure reduces the financial barrier to entry by allowing a minimum share capital of just €1, compared to the €2,800 required for a standard SIA. Additionally, the Flex SIA allows founders up to five years to reach the full capital requirement.

The process for forming a Flex SIA is similar to that of a standard SIA, with the main difference being the capital declaration and deposit requirements. Once the share capital reaches €2,800, the company automatically transitions to a standard SIA without the need for a formal conversion process. Despite the reduced initial capital, Flex SIAs enjoy the same legal rights and protections as standard SIAs. However, there are restrictions on dividend payments until the capital reaches the required €2,800.

The Flex SIA is ideal for entrepreneurs and small businesses looking for flexibility in their early stages. It allows businesses to grow organically and increase capital over time. Though it offers significant advantages, including low entry costs, founders should consider the long-term implications of the lower capital when making business decisions.

Opening a bank account for your SIA in Latvia is a crucial step when establishing your business operations. Latvia boasts a strong banking sector, with both local and international banks offering a range of services. The process typically involves selecting a bank and preparing the necessary documentation, including:

Banks in Latvia, in compliance with anti-money laundering regulations, may require additional documentation to verify the source of funds and the nature of the business. Some banks may also require personal visits or have specific requirements for foreign entrepreneurs.

It’s advisable to engage a local corporate service provider to help navigate these requirements. They can facilitate introductions to banks, provide insights into account options and associated fees, and assist with all necessary paperwork. This expertise ensures you meet regulatory obligations efficiently and can help avoid delays in your business operations.

The costs of setting up an SIA in Latvia can vary depending on several factors. Initial costs typically include state registration fees, which range from €150 for standard registration to €450 for same-day processing. For a standard SIA, the minimum share capital required is €2,800, whereas a Flex SIA can start with as little as €1 and must reach the standard capital within five years.

Additional costs may include notary fees for certifying documents (€100-€200), legal address services (from €30 per month), and the optional company name reservation fee of €14. Other costs to consider are translation fees for documents (€15-€25 per page), legal and accounting services (ranging from €300 to €1,000 for formation services), and VAT registration (free if done alongside company registration).

Ongoing costs include annual filing of reports, legal and accounting compliance (ranging from €1,000 to €3,000 annually), and office maintenance. While Latvia provides a cost-effective environment for business formation, it’s important to account for both the initial setup and ongoing operational expenses to ensure smooth operations.

Understanding the tax implications for your SIA in Latvia is essential for effective business planning. Latvia offers a competitive tax environment with a corporate tax rate of 20%, which is favorable compared to many other EU jurisdictions.

Key taxes that may affect your business include VAT, with a standard rate of 21%, and a reduced rate of 12% for certain goods and services. Social security contributions are also applicable for employees, with rates set by the government, and personal income tax is levied at a flat rate of 20%.

Latvia has a robust network of double tax treaties, which can be beneficial for international businesses to avoid double taxation and reduce tax liabilities. While the corporate tax rate is straightforward, your overall tax situation may vary depending on your company's activities and structure.

To optimize your tax position and ensure compliance with Latvia’s tax laws, it’s highly recommended to consult with a local tax advisor or professional services firm. The House of Companies can offer comprehensive guidance to ensure your business adheres to the latest tax regulations and maximizes its potential tax benefits.

To start an SIA (Sabiedrība ar ierobežotu atbildību) in Latvia, you’ll need to submit specific details to the Latvian authorities. These include the proposed company name, the details of shareholders and directors (full names, addresses, and nationalities), the company’s registered office address, the amount and distribution of share capital, and the main business activities of the company.

Identification documents for all shareholders and directors are required, such as passports and proof of address. If any shareholders are corporate entities, additional documents like certificates of incorporation and good standing must also be provided. For foreign nationals, notarized translations of documents into Latvian may be necessary.

It is essential to ensure that all information is accurate and up-to-date. Providing false or misleading information can lead to delays or legal consequences. To streamline the registration process and ensure compliance, it is advisable to consult with a local corporate service provider.

In Latvia, reserving a company name is an essential first step when establishing an SIA (limited liability company). This process involves submitting an application to the Latvian Register of Enterprises (Uzņēmumu reģistrs), where the proposed name will be evaluated for uniqueness and compliance with the country's regulations.

The company name must not only be distinctive but also avoid being similar to existing registered companies, trademarks, or any names that could cause confusion. The name should reflect the nature of the business and cannot be misleading. It is required to end with the abbreviation "SIA" to clearly indicate that the company is a limited liability entity. Once approved, the name is reserved for six months, within which time the company formation must be finalized.

If the name reservation period is about to expire and the registration process is not complete, an extension can be requested. It is always advisable to have alternative names on hand, in case the preferred name is unavailable or rejected. The entire process is governed by Latvia's Commercial Law, which ensures the proper protection of company names and trademarks during the business formation process.

For further information, you can visit the official website of the Latvian Register of Enterprises: www.ur.gov.lv.

In Latvia, selecting a registered office address is a crucial step in the company formation process. Every company, including an SIA (limited liability company), must have a valid registered office address in Latvia. This address is where official correspondence, legal notices, and government communications will be sent. It must be a physical address, not a P.O. Box.

There are several options for obtaining a registered office address in Latvia:

Physical Office Location: You can lease or own a commercial space that serves as the company’s official address. The address should be in a location recognized for business activities and easily accessible.

Virtual Office Services: For startups or foreign entrepreneurs who do not need a physical office space, a virtual office service is a viable option. These services provide a professional business address along with additional services such as mail forwarding and phone answering. Virtual offices are a cost-effective solution for small businesses or companies in the early stages of their operation.

Shared Office Spaces: Many entrepreneurs opt for shared office spaces, which provide not only a registered office address but also access to meeting rooms and administrative support. These can be a good choice for businesses looking for flexibility and lower costs.

The registered office address must be provided when submitting the company’s registration documents to the Latvian Register of Enterprises. It is important to ensure the address is valid and compliant with Latvian regulations. Additionally, the address should be kept up to date in the official company records, as it is a legal requirement for communication purposes.

In Latvia, appointing directors is a critical step when setting up a company, whether it's an SIA (limited liability company) or another business structure. The minimum requirement is one director, who can be a resident or non-resident. However, having more directors can help distribute responsibilities and improve oversight. Directors must be at least 18 years old, capable of fulfilling their duties, and not disqualified or criminally convicted.

Directors are responsible for managing the company’s operations, ensuring compliance with Latvian laws, and fulfilling obligations like financial reporting and tax filings. Their appointment is formalized through a decision made by the shareholders and recorded in the company’s internal documents, then updated with the Latvian Register of Enterprises. Non-resident directors are allowed, but they may face additional compliance obligations.

While directors can be paid for their services, it is not required. Many businesses formalize the director’s role through a written contract, which outlines their responsibilities and compensation. Ensuring the right directors are appointed is essential for the success of the business, and consulting with local legal or corporate experts is recommended to navigate the process efficiently.

Are you ready to take your business to the next level in Latvia? Before you dive in, it’s crucial to understand the business license requirements that apply to your specific industry.

Understanding the licenses you need is key to ensuring your business operates legally and successfully in Latvia. Depending on your industry, you may need various permits, from general business licenses to specialized certifications. This ensures compliance with local regulations and builds trust with your customers.

If you're unsure where to start, don’t worry! Our expert team is here to guide you through the entire process. We’ll help you identify the necessary licenses for your business in Latvia, streamline your application process, and make sure you meet all the local requirements. With our support, you can focus on what you do best—running your business!

In Latvia, the Share Capital Requirements for a SIA (Sabiedrība ar Ierobežotu Atbildību), which is a type of private limited liability company, are as follows:

Minimum Share Capital: The minimum share capital required for a SIA is 2,800 EUR. This is the total amount that shareholders must contribute to the company when it is incorporated.

Payment of Share Capital: At least 50% of the share capital must be paid up before the company is registered. The remaining portion can be paid within a specified period after registration, typically within the first year.

Nominal Value of Shares: The nominal value of each share in a SIA must be at least 1 EUR. This means that the shares can be issued in whole numbers, but the total share capital must equal or exceed the minimum requirement.

Contributions: Share capital can be contributed in various forms, including monetary contributions (cash) or non-monetary contributions (such as property or intellectual property). The value of non-monetary contributions must be assessed and documented according to Latvian law.

These requirements ensure that the company has sufficient financial resources for its operations and protects creditors by having a base level of capital. If you're looking to establish an SIA in Latvia, our team can guide you through the process and ensure all capital and registration requirements are met.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!