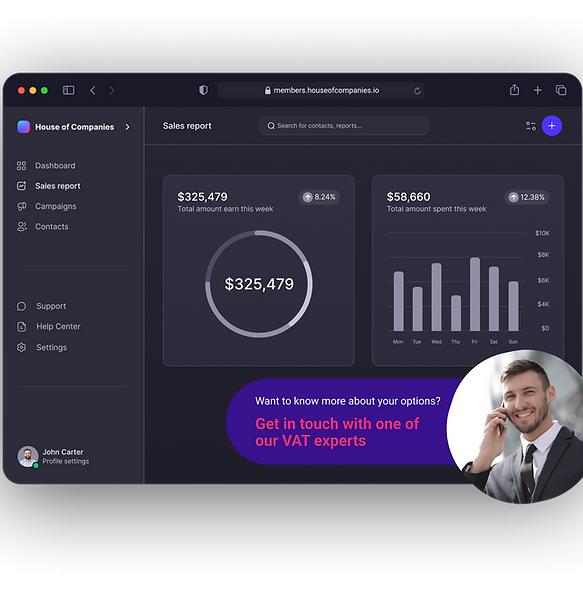

With our Entity Management Portal, you can easily become an Employer of Record (EOR) in Latvia without the need to establish a local entity. Our solution offers a cost-effective and simple approach, avoiding the high fees of traditional Professional Employer Organizations (PEOs). Whether you're hiring your first employee or managing a growing team, we enable you to handle payroll effectively, keeping your costs to a minimum.

By using our Entity Management Portal, you can register as an overseas employer and save significantly on payrolling fees. Forget the typical €600+ monthly costs of PEOs — with us, you can reduce costs to as little as €10 per employee.

Once you're registered as an employer in Latvia, our portal offers the tools to manage your staff and expand your business seamlessly.

"Our expansion into Latvia was simplified with this platform. We avoided unnecessary costs and could focus on growing our team."

IT Consultant

IT Consultant"The platform was a game-changer for our recruitment efforts in Latvia. We didn’t have to navigate the complexities of forming a local company."

Global Retailer

Global Retailer"Affordable and efficient! The Entity Management Portal allowed us to hire quickly while staying compliant with local laws."

Marketing Agency

Marketing AgencyLooking for comprehensive HR support? House of Companies offers end-to-end facilitation by an HR Officer or Professional Employer Organization (PEO) through our innovative Launch Grid Portal. A centralized platform that simplifies HR management and payroll processing.

This service is part of our Entity Management Service, catering to both EU and non-EU nations. It empowers businesses with the tools and support needed to manage their workforce effectively, ensuring smooth and compliant operations globally.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!