In this article, we explore the essential aspects of accounting and tax compliance for non-resident companies in Latvia, and how House of Companies has streamlined and simplified Latvian accounting.

We cover key topics such as corporate income tax, bookkeeping requirements, and the advantages of the Latvian tax system. By understanding these critical elements, you can effectively manage your financial affairs and take full advantage of the business opportunities within Latvia's favorable business environment.

Latvia provides a robust framework for accounting and tax compliance, designed to foster a business-friendly environment while ensuring adherence to legal requirements. Companies in Latvia must prepare their financial records according to International Financial Reporting Standards (IFRS) or Latvian Accounting Standards (LAS), depending on the company’s size and nature. One of the most appealing aspects of Latvia's tax system is the corporate income tax structure, which taxes only distributed profits at a rate of 20%, offering businesses the flexibility to reinvest profits without immediate tax liabilities.

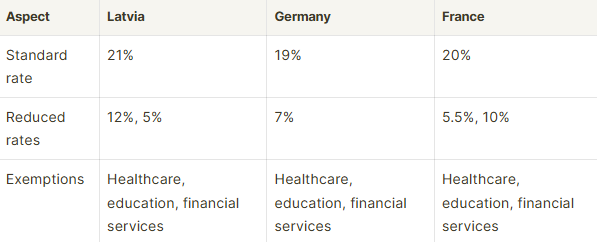

In addition to corporate income tax, businesses are required to maintain comprehensive bookkeeping records, file annual financial statements, and, depending on the size of the company, undergo audits to ensure financial accuracy and transparency. Latvia also operates a VAT system, where businesses with an annual turnover above a certain threshold must register for VAT, with the standard rate being 21%. Certain goods and services may qualify for reduced rates of 12% or 5%, offering potential tax savings.

Employers in Latvia must manage payroll and social security obligations, including withholding income tax and employee contributions to Latvia's social security system. Businesses must also contribute to social security on behalf of their employees, covering pensions, healthcare, and other welfare services. Adherence to tax filing deadlines is critical, with businesses required to submit annual tax returns by June 30th of the following year, and periodic VAT and payroll tax filings on a regular basis.

To navigate these complex regulatory requirements, many businesses turn to services like House of Companies. With expertise in Latvian accounting practices, tax filing, and compliance, House of Companies provides a streamlined solution to help businesses meet their obligations while minimizing risk. By leveraging their knowledge, businesses can avoid penalties, ensure accurate reporting, and focus on growth and expansion in Latvia’s thriving market.

Maximize your business potential with expert Latvian accounting services from House of Companies. Latvia's business-friendly environment offers numerous tax advantages, including a corporate income tax rate of 20% on distributed profits. This system allows businesses to reinvest their earnings without the burden of immediate tax payments, making it an ideal location for companies aiming to grow and expand.

At House of Companies, we specialize in managing all aspects of your accounting needs, from bookkeeping to tax filing. We ensure your financial records comply with Latvian Accounting Standards (LAS) or International Financial Reporting Standards (IFRS), depending on the size and nature of your business. Our services cover a wide range of compliance requirements, including the preparation and submission of annual financial statements, handling VAT registration, and overseeing regular VAT returns.

With VAT rates at 21% for most goods and services, and reduced rates of 12% and 5% for specific items, navigating this tax system can be complex. Our experts guide you through the entire process, ensuring that your business takes advantage of all available tax savings.

We also handle payroll and social security obligations, including the withholding of income tax and employee contributions. Our team ensures that your business meets deadlines for tax filings and avoids costly penalties for non-compliance.

By working with House of Companies, you can focus on growing your business while we take care of the accounting complexities. We offer tailored solutions that ensure your company remains compliant, accurate in financial reporting, and well-positioned to succeed in Latvia's dynamic business landscape. Whether you are setting up a new business or managing an established one, our expert team provides the support you need to thrive in Latvia.

Understanding Latvian accounting regulations is essential for businesses to ensure compliance and optimize financial efficiency. Latvia's legal framework outlines clear accounting standards, with smaller businesses using Latvian Accounting Standards (LAS) and larger entities or public companies following International Financial Reporting Standards (IFRS).

Latvia's corporate income tax system imposes a 20% tax on distributed profits, encouraging businesses to reinvest earnings. Companies are not taxed on profits that remain within the business, but dividends paid to shareholders are taxed. VAT registration is required for businesses with an annual turnover exceeding €40,000, with a standard rate of 21% and reduced rates of 12% and 5% for certain goods and services. Businesses must ensure proper VAT accounting and timely submissions of VAT returns.

Bookkeeping is a requirement for businesses in Latvia, with accurate records of financial transactions and supporting documentation. Companies must prepare annual financial statements, which include a balance sheet, income statement, and cash flow statement, and submit them to the Register of Enterprises. Audit requirements depend on the size of the business, with larger companies or those exceeding specific thresholds needing audited financial statements.

Employers in Latvia are also responsible for withholding income tax and social security contributions from employee wages. The rates for payroll taxes and social security vary depending on the income level of employees.

Tax filings, including corporate income tax, VAT, and payroll tax returns, must be submitted on time to avoid penalties. The deadline for corporate tax returns is June 30th of the following year, while VAT and payroll tax filings are typically due quarterly or monthly.

To navigate these regulations, businesses can seek professional accounting services. House of Companies offers expert guidance, ensuring businesses stay compliant with Latvian accounting requirements and efficiently manage their financial obligations.

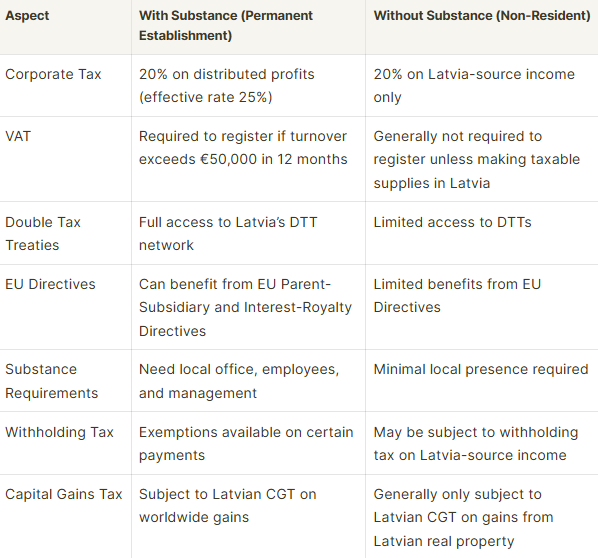

When setting up a business in Latvia, it is crucial to understand the difference between a company with substance (Permanent Establishment) and one without (non-resident). This distinction has significant implications for corporate tax obligations and VAT compliance. At House of Companies, we offer comprehensive entity management services to guide you through these complexities and help you make informed decisions based on your business needs.

A Latvian company with substance, also referred to as a Permanent Establishment (PE), has a physical presence in the country, such as an office, employees, or operational activities. Companies with substance are subject to Latvian corporate income tax on their worldwide income. The standard corporate tax rate is 20%, but only on distributed profits. In addition, these businesses must comply with Latvian VAT regulations if they engage in taxable activities within Latvia. They are required to register for VAT once their taxable turnover exceeds the threshold set by Latvian tax authorities.

On the other hand, a non-resident company without substance in Latvia does not have a Permanent Establishment. These businesses are generally only taxed on income sourced from Latvia. Non-resident companies do not face the same corporate tax obligations as resident companies but may still need to comply with VAT requirements if they carry out taxable activities in Latvia. The VAT obligations for non-resident companies are different from those for resident companies, and the VAT registration threshold may vary depending on the type of activities they engage in.

Choosing the appropriate business structure is essential and depends on your operations and objectives. At House of Companies, we provide expert advice on whether establishing a company with or without substance is the best fit for your business. Our services help you navigate tax regulations, ensure compliance, and make the best decisions for your business's success in Latvia. Let us guide you so you can confidently expand your business in this dynamic market.

n Latvia, non-resident entrepreneurs have several legal entity options to choose from based on their business needs. The Limited Liability Company (SIA) is the most common choice, offering limited liability protection and a minimal capital requirement of €1. This structure is suitable for small to medium-sized businesses and allows non-residents to fully own and manage the company. The Joint Stock Company (AS) is more suited for larger enterprises, requiring a minimum share capital of €35,000, and it can raise capital through the sale of shares.

Non-residents can also establish a Branch of a Foreign Company, which operates under the parent company's liability but is subject to Latvian corporate tax on Latvian-sourced income. Another option is a Representative Office, ideal for foreign companies that want to promote their business in Latvia without engaging in direct commercial activities. Partnerships, such as the Limited Partnership (SIA) or General Partnership (LTA), are available for non-residents looking to collaborate with others, offering different levels of liability. Lastly, Sole Proprietorships are an option for individual entrepreneurs, though they come with unlimited personal liability.

Each legal entity offers different levels of liability and flexibility, so non-residents should carefully consider their business goals and consult with professionals to choose the best structure for their operations in Latvia.

When registering a branch office in Latvia, it’s important to understand the accounting implications to ensure compliance with local regulations. A branch office is not considered a separate legal entity from its parent company, meaning it is directly linked to the parent’s financial structure. However, it is still subject to Latvian tax and accounting regulations for any income derived within Latvia.

From an accounting perspective, the branch must maintain separate financial records for its operations in Latvia. It will need to submit local tax returns and potentially comply with local VAT requirements, depending on the scale of its activities. Corporate income tax will apply to any Latvian-sourced income, and the branch is required to prepare annual financial statements in line with Latvian accounting standards, which may differ from the parent company's accounting practices.

Additionally, while the branch itself does not require a minimum capital investment, it should ensure that sufficient resources are allocated to support its operations in Latvia. This includes accounting for any transactions between the parent company and the branch, such as transfer pricing, to avoid potential tax issues.

House of Companies offers end-to-end support for non-resident businesses, from initial registration to ongoing compliance. We make managing a branch office simple, so you can focus on expanding your operations in Latvia, while we handle all aspects of accounting and regulatory requirements. With our expertise, you can confidently navigate the complexities of Latvian business operations.

Non-resident entities should consult with legal and tax advisors to determine the best structure for their operations in Latvia. House of Companies offers a tailored corporate plan to assist with this process. Let us help you establish and manage your branch office in Latvia with the expertise and support you need to succeed.

Tax registration requirements for non-resident entities in Latvia are essential for ensuring compliance with local tax laws. Non-resident entities wishing to conduct business in Latvia must register for tax purposes to meet obligations, including corporate income tax, VAT, and payroll taxes.

If a non-resident entity derives income from Latvian sources, it must register for corporate income tax with the State Revenue Service (VID). Corporate income tax is levied on profits generated in Latvia, with a current rate of 20%.

Additionally, non-resident entities engaged in taxable activities, such as selling goods or services, must register for VAT if their annual turnover exceeds €40,000. Once registered, they must charge VAT on taxable transactions and can claim VAT deductions on business-related purchases.

For non-resident entities with employees in Latvia, payroll tax registration is also required. This involves registering with VID to withhold income tax and social security contributions from employee salaries. Non-resident employers must comply with the same payroll tax rules as local entities, ensuring proper tax deductions are made.

Furthermore, non-resident entities with intra-group transactions involving a Latvian branch must comply with transfer pricing regulations, ensuring that these transactions are conducted at arm's length. Proper documentation and reporting must be maintained.

To avoid penalties and ensure compliance, non-resident entities should seek guidance from local tax advisors or entity management services. House of Companies provides comprehensive support, assisting businesses in navigating Latvia’s tax registration and compliance requirements.

VAT registration in Latvia is a requirement for businesses involved in VAT-taxable transactions. If your business engages in the sale of goods or services subject to VAT, you must register with the State Revenue Service (VID) for VAT purposes. This is particularly important if your taxable turnover exceeds the VAT registration threshold of €40,000 annually.

Once registered, businesses are obligated to charge VAT on their taxable goods or services at the applicable rate, which is generally 21%, though reduced rates may apply to certain goods and services. Registered businesses can also claim back VAT on business-related purchases, which can reduce their overall tax burden.

The VAT registration process involves submitting an application to the VID, where you will need to provide details of your business activities, anticipated turnover, and any other relevant information. After approval, your business will be issued a VAT number, and you will be required to file VAT returns on a regular basis, typically quarterly or monthly.

Failing to register for VAT when required can lead to penalties and interest charges, so it’s crucial for businesses to monitor their turnover and ensure timely registration. For non-resident businesses operating in Latvia, VAT registration may be required even if they do not have a physical presence in the country, as long as they are making taxable sales.

To ensure compliance and avoid costly mistakes, it’s advisable to seek guidance from local tax advisors or professional services like House of Companies. We offer full support in the VAT registration process, ensuring that your business meets all legal requirements in Latvia efficiently.

Employer registration for payroll in Latvia is a necessary step for businesses that hire employees. If you are a non-resident entity with employees working in Latvia, you must register as an employer with the State Revenue Service (VID) to comply with local payroll tax regulations.

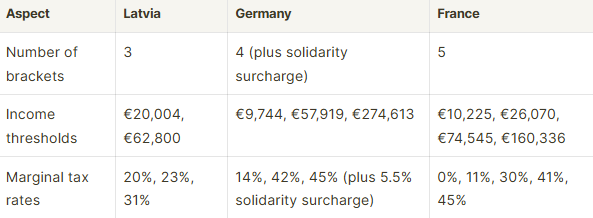

Once registered, the employer is responsible for withholding income tax, social security contributions, and other payroll-related taxes from employees’ salaries. These deductions must be remitted to the VID on a monthly basis. The income tax rate is progressive, ranging from 20% to 31%, depending on the salary amount, while social security contributions cover pensions, health insurance, and other benefits.

The registration process involves submitting an application to the VID with details about your company, the number of employees, and other relevant information. As an employer, you are also required to provide employees with pay slips, file monthly payroll tax returns, and keep detailed records of all payroll transactions for audit purposes.

It’s essential to ensure timely and accurate payroll tax filings to avoid penalties for non-compliance. Businesses must also stay up to date with any changes in tax rates or regulations. Non-resident employers, in particular, should consult with local tax advisors or entity management services to ensure they fully understand and comply with all Latvian payroll tax requirements.

House of Companies provides comprehensive payroll services, including employer registration, ongoing compliance support, and tax filing assistance, allowing you to focus on your business operations while we manage the complexities of payroll tax requirements in Latvia.

Corporate tax liability for resident companies in Latvia is governed by the Latvian corporate income tax (CIT) system, which imposes tax on profits generated within the country. The standard corporate income tax rate is 20%, applied to the company’s annual profit.

However, Latvia operates on a unique taxation system where corporate income tax is only levied when profits are distributed, rather than when they are earned. This means that resident companies do not pay corporate tax on retained earnings. Corporate tax liability arises when the company pays dividends, makes certain types of distributions, or carries out other transactions that involve profit distribution. In these cases, the full 20% CIT is applied.

Companies may also benefit from various deductions, including expenses related to business operations, and there are exemptions for certain types of income, such as capital gains on the sale of shares, under specific conditions. Additionally, companies may be eligible for tax incentives and relief programs, such as the application of a lower tax rate for reinvested profits under Latvia’s progressive tax model.

To ensure compliance, resident companies are required to file annual tax returns and make quarterly advance tax payments based on estimated profit distributions. Maintaining accurate financial records and tax documentation is essential to meet these obligations and avoid penalties.

Companies are encouraged to consult with local tax advisors or professional services like House of Companies to navigate the complexities of corporate tax liability, taking advantage of available tax planning strategies and ensuring full compliance with Latvian tax laws.

In Latvia, bookkeeping and financial reporting are crucial aspects of business operations that ensure compliance with local regulations. All businesses, including resident and non-resident companies, are required to maintain accurate financial records and submit regular reports to the State Revenue Service (VID) and other relevant authorities.

Latvian accounting standards align with International Financial Reporting Standards (IFRS) for larger companies, while smaller entities may follow the Latvian Generally Accepted Accounting Principles (LGAAP). Companies must record all financial transactions, including income, expenses, assets, and liabilities, in a systematic manner. Proper bookkeeping is essential not only for tax compliance but also for business transparency and decision-making.

For financial reporting, companies in Latvia are required to prepare annual financial statements that include a balance sheet, profit and loss statement, and cash flow statement. These statements must be audited if the company exceeds certain thresholds, such as turnover or asset value. The financial reports must be submitted to the VID and made publicly available, offering transparency to stakeholders and potential investors.

Non-resident entities operating in Latvia must also comply with these bookkeeping and reporting obligations, even if they do not have a physical presence in the country. They are required to report their Latvian operations separately from the parent company’s financial statements.

House of Companies provides comprehensive bookkeeping and financial reporting services, helping businesses manage their financial records and comply with Latvian regulations. Our team ensures that all transactions are accurately recorded, reports are prepared on time, and your business stays compliant with local tax and reporting requirements. Let us take care of the financial details so you can focus on growing your business.

Tip: No Need to Register a Local Company for Payroll Tax Compliance

Non-resident businesses in Latvia can register directly with the State Revenue Service (VID) for payroll tax compliance, without needing to establish a local company. This enables them to manage payroll, withhold taxes, and make necessary contributions. House of Companies can assist with the registration and ensure full compliance with Latvian payroll requirements.

For large companies, those meeting certain criteria regarding turnover, total assets, or number of employees, a statutory audit is mandatory. This applies to companies that exceed specific thresholds set by Latvian law. These companies are required to have their financial statements audited annually by an external, certified auditor to ensure accuracy and compliance with the Latvian accounting standards or International Financial Reporting Standards (IFRS), as applicable.

For small and medium-sized enterprises (SMEs), the audit requirement may be waived, but they are still required to prepare annual financial statements. However, if they meet the criteria that define them as "large" under Latvian law, an audit will be required regardless of their size as a business.

Additionally, subsidiaries of foreign parent companies may be subject to audit requirements based on their parent company’s jurisdiction, particularly if the parent company’s own audit obligations extend to the subsidiaries.

House of Companies can assist businesses in understanding their specific audit requirements and ensuring that financial statements are in full compliance with Latvian regulations, streamlining the process for companies to meet their legal obligations.

Public companies and companies that meet certain size criteria, such as large entities with significant turnover, total assets, or a high number of employees, must publish their financial statements. These companies are required to file their annual financial statements with the Register of Enterprises, where they are made available for public viewing. This ensures transparency and allows stakeholders, including investors, creditors, and regulators, to review the company’s financial health.

Small and medium-sized enterprises (SMEs), while still required to prepare financial statements, may have fewer stringent publication obligations. SMEs are typically not required to publish their full financial statements publicly, but they must submit them to the Register of Enterprises, where they will be available to certain stakeholders upon request.

For subsidiaries, the parent company may be subject to additional publication requirements, depending on the jurisdiction of the parent. If the parent is based in an EU country, its consolidated financial statements might need to be published, which may include information from Latvian subsidiaries.

House of Companies can assist in ensuring that businesses meet all necessary publication requirements, helping to streamline the submission and publication of financial statements in line with Latvian legal standards.

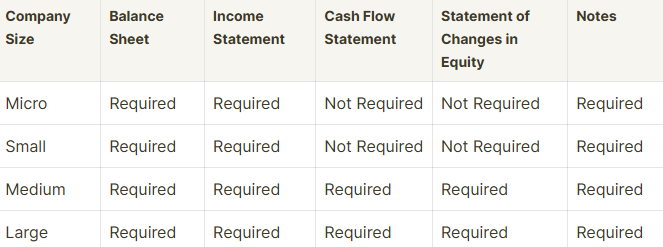

In Latvia, all companies, regardless of size, are obligated to file annual accounts with the Register of Enterprises. The filing must include a set of financial statements, typically consisting of the balance sheet, income statement, cash flow statement, and notes to the financial statements. These documents provide a comprehensive overview of the company’s financial health and performance over the fiscal year.

Large companies are required to prepare their annual accounts according to International Financial Reporting Standards (IFRS) or Latvian Generally Accepted Accounting Principles (LGAAP), and submit them within 12 months of the end of the financial year. These companies must also file an auditor's report if their financial statements are subject to an audit.

Small and medium-sized enterprises (SMEs) can file their financial statements in accordance with simplified reporting standards under LGAAP. While the filing obligation still exists, SMEs may not need to undergo a full audit unless they meet specific criteria that make them subject to audit requirements.

The annual accounts must be submitted to the Register of Enterprises, where they become publicly accessible for certain stakeholders. Failure to comply with the filing obligations can lead to penalties and potential legal consequences.

House of Companies provides full support in preparing, filing, and ensuring compliance with annual accounts obligations, helping businesses meet all necessary legal requirements efficiently.

In Latvia, companies, including non-resident entities operating through a permanent establishment, are required to file annual financial statements and ensure they meet publication requirements. These regulations ensure transparency and compliance with local laws.

Annual Financial Statements: Companies must file their annual financial statements with the Register of Enterprises. These documents should include a balance sheet, income statement, cash flow statement, and notes on financial performance.

Publication of Financial Statements: After submission, the financial statements must be made publicly available. The company must publish them on the Register of Enterprises’ website within a specified period. This ensures that stakeholders, such as investors, creditors, and authorities, can access the company's financial information.

Audit and Approval: If the company meets specific criteria, it must have its financial statements audited. After the audit, the statements must be approved by the company's governing body (e.g., board of directors) before being filed and published.

Deadlines: Companies must file their annual financial statements within 12 months of the end of the financial year, and these documents should be published shortly after approval.

Non-resident entities should ensure they meet these filing and publication obligations to comply with Latvian corporate law.

Foreign businesses operating in Latvia must register for VAT if they exceed the sales threshold or engage in taxable transactions within the country. This applies to companies with a permanent establishment in Latvia, as well as those involved in cross-border sales. Upon registration, businesses are required to charge VAT on taxable supplies and adhere to Latvia's VAT regulations.

The standard VAT rate in Latvia is 21%, though reduced rates may apply to certain goods and services. Registered businesses must file regular VAT returns to report their taxable transactions and ensure compliance with local tax laws. Maintaining accurate VAT documentation, such as compliant invoices, is essential to avoid penalties and ensure proper reporting.

Additionally, foreign businesses may be eligible for VAT refunds on business-related expenses incurred in Latvia. It’s important for businesses to understand the specific criteria for claiming refunds, and consulting with local tax professionals can help ensure compliance and optimize VAT handling.

In Latvia, businesses are required to adhere to certain accounting standards depending on their size, business activity, and whether they are public or private entities. The two main frameworks used are Latvian GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Understanding the differences between these two is essential for ensuring compliance and proper financial reporting.

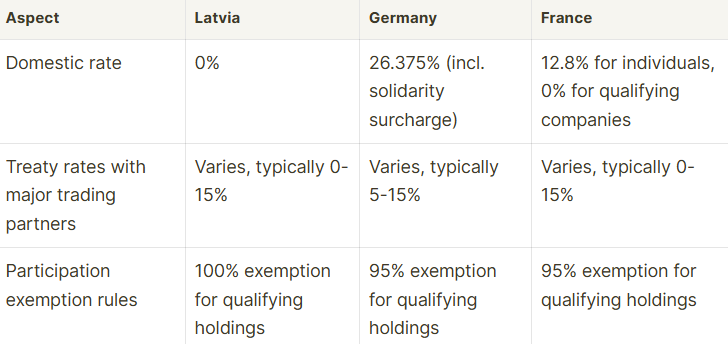

Receiving or paying dividends to or from a group company in Latvia is subject to specific tax regulations. Latvia generally follows a favorable dividend taxation regime, with a significant exemption for dividends received by a Latvian resident company from a foreign subsidiary, provided certain conditions are met. If a Latvian company receives dividends from a foreign group company, the dividends may be exempt from corporate income tax if the Latvian company holds at least 10% of the shares in the foreign subsidiary and has held them for at least two years.

When it comes to paying dividends to shareholders, companies must withhold tax at the applicable rate, which is typically 20%. However, Latvia has a network of double taxation treaties, which may reduce the withholding tax rate for foreign shareholders. It’s important for businesses to review these treaties and determine the appropriate tax rate to apply to dividend payments to non-residents. Proper planning and compliance with Latvian tax laws can help minimize the tax burden and avoid any potential issues.

In Latvia, branch offices of foreign companies do not face withholding tax on dividends, interest, or royalty payments. This is one of the key advantages of operating through a branch rather than a subsidiary in Latvia. Since a branch is considered an extension of the foreign parent company, it is not treated as a separate legal entity. As a result, there is no requirement to withhold tax on cross-border dividend payments from the Latvian branch to its parent company.

However, it is important to note that the branch's income will still be subject to corporate income tax in Latvia on profits generated within the country. Despite the absence of withholding taxes on dividends, foreign companies should ensure compliance with local tax reporting requirements and consult with tax advisors to understand the implications for their specific business structure.

In Latvia, companies are required to submit their annual financial statements to the Register of Enterprises by June 30th of the year following the reporting period, based on the calendar year. These statements must include a balance sheet, income statement, and cash flow statement, as well as a management report detailing the company’s financial performance and activities.

For larger companies or those meeting specific criteria, an audit may be required, and the auditor's report must also be submitted along with the financial statements. Failure to meet these deadlines or comply with the reporting requirements can result in penalties and legal consequences. Therefore, timely submission and accurate reporting are essential for maintaining good standing with Latvian authorities.

Annual Financial Statements:

Tax Return Filing:

Failure to comply with annual reporting and filing requirements can result in significant penalties, including:

In Latvia, companies must undergo an audit if they meet certain criteria based on size. These thresholds determine whether a company is required to have an audit of its annual financial statements.

General Criteria for Mandatory Audit:

Companies Not Meeting the Audit Criteria:

Public Companies and Listed Entities:

SMEs and Exemptions:

These thresholds aim to balance the auditing burden with the size and scope of a business, ensuring that larger companies and those with greater public impact are subject to more stringent auditing requirements.

Note: Companies are classified based on meeting at least two of the three criteria (Assets, Turnover, Employees) for their respective size category.

1. Are small businesses in Latvia required to have an audit?

In Latvia, small businesses may be exempt from the audit requirement if they meet certain criteria. Typically, businesses with an annual turnover of less than €1.4 million, total assets under €700,000, and fewer than 50 employees are exempt from mandatory audits. These businesses can submit unaudited financial statements, but they must still adhere to Latvian accounting standards and regulations.

2. What happens if a company doesn't meet the audit exemption criteria?

If a company in Latvia exceeds the criteria for the audit exemption, it is required to have its financial statements audited by a licensed auditor. The company must then submit the audited financial statements to the Latvian Register of Enterprises, ensuring compliance with local accounting and tax regulations.

3. Do companies still need to file financial statements if they qualify for the audit exemption?

Yes, even if a company qualifies for the audit exemption, it is still required to file financial statements with the Latvian Register of Enterprises. These statements must comply with the Latvian Accounting Law, regardless of whether the company’s financial statements are audited or not.

4. What are the consequences of failing to comply with audit or filing requirements?

Failure to comply with audit or filing requirements in Latvia can result in penalties, including fines and late fees. In severe cases, persistent non-compliance may lead to the company’s registration being canceled by the Latvian Register of Enterprises, resulting in the loss of its legal status.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!