At House of Companies, we specialize in providing expert corporate tax compliance services to non-resident businesses operating in Latvia. Our team of experienced professionals helps foreign investors, entrepreneurs, and company owners navigate the complexities of Latvia's tax regulations. We ensure that your business remains fully compliant with Latvian tax laws, reducing risk and streamlining your operations.

With our support, you can focus on growing your business internationally, while we handle your tax compliance needs with precision and expertise. Trust House of Companies to manage your corporate tax obligations in Latvia efficiently, so you can expand globally with confidence.

At House of Companies, we simplify bookkeeping with advanced technology. From data entry to financial reporting, everything is streamlined and up-to-date in real-time. Track your progress and profits effortlessly, while we handle the numbers, so you can focus on growing your business.

"We switched to automated bookkeeping services and have seen a tremendous improvement in our financial management. The accuracy and efficiency are unmatched."

Global Talent Recruiter

Global Talent Recruiter"Automated bookkeeping has allowed us to focus on growing our business without worrying about the intricacies of financial record-keeping."

Spice & Herb Exporter

Spice & Herb Exporter"The real-time reporting feature has been a game-changer for our financial planning and decision-making."

Tech Company

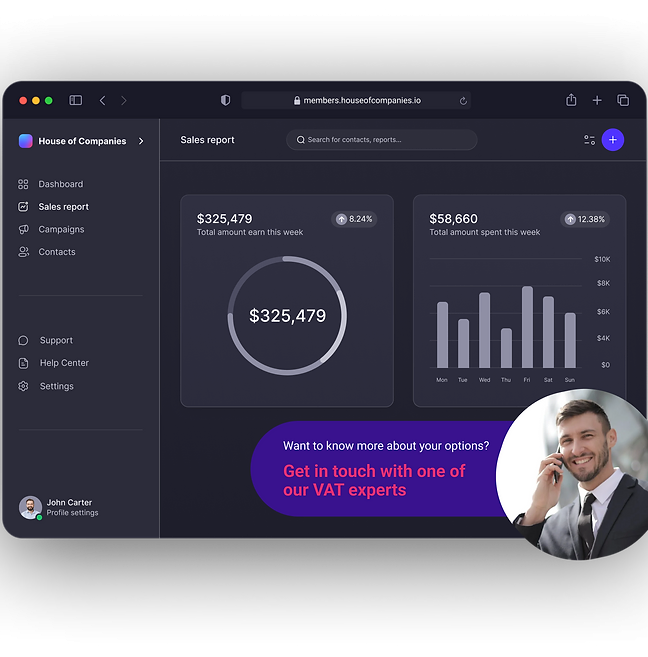

Tech CompanyIf your business requires comprehensive tax support, our international tax officers are here to help. Navigating the complexities of Latvian tax regulations can be challenging, but our experienced professionals provide personalized assistance to ensure full compliance.

Whether you need help with tax filings, VAT analysis, or setting up new ledgers, our team at House of Companies is equipped to handle all your tax-related needs.

Learn More →

Learn More →

Learn More →

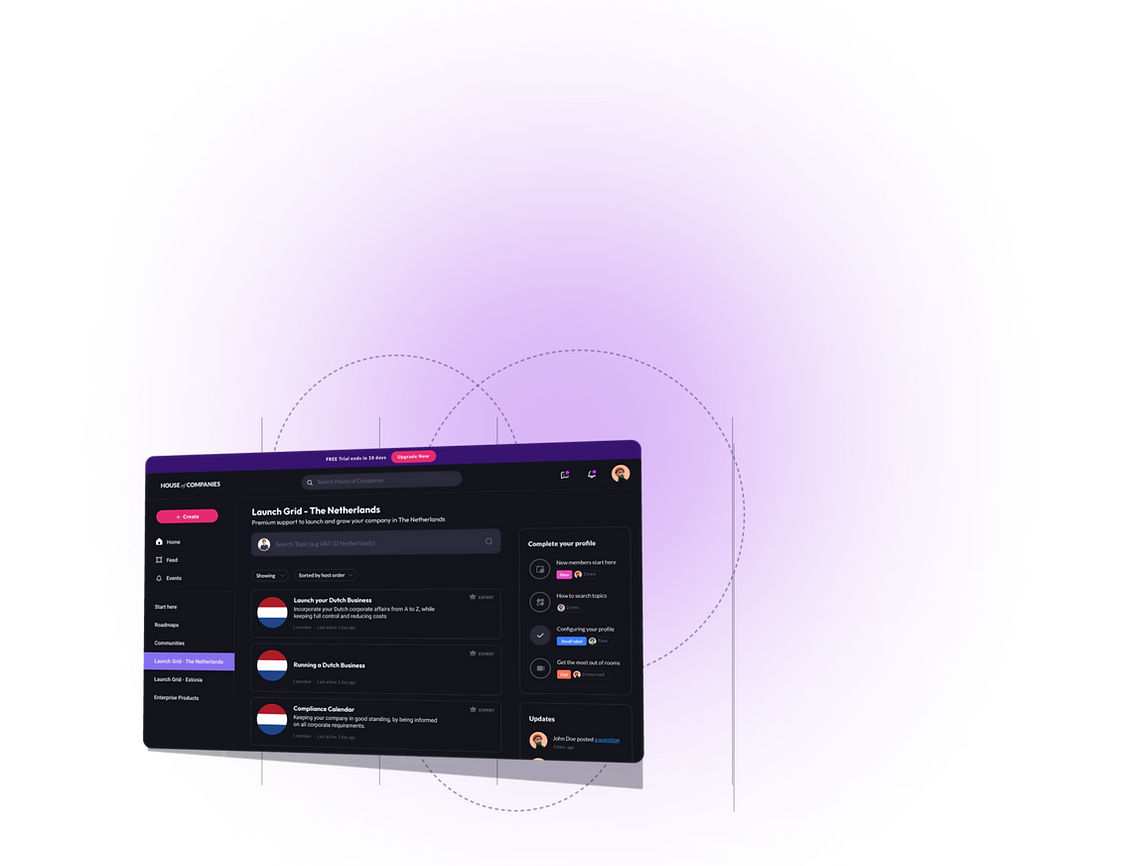

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!