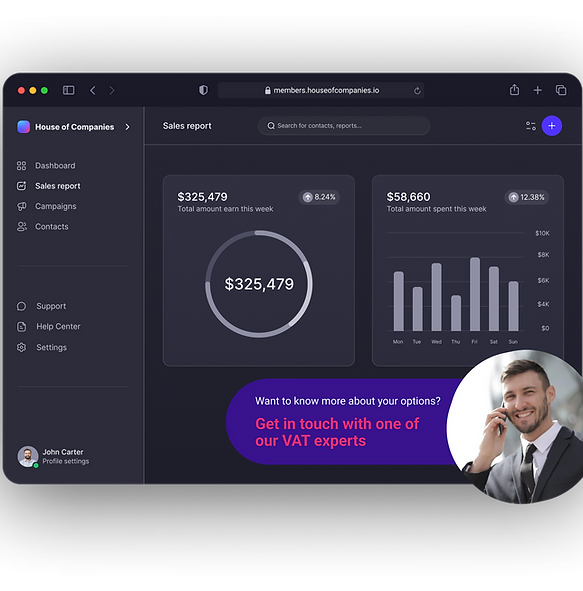

Our team of European VAT experts is available to provide personalized support tailored to your specific needs. Whether you require assistance with complex VAT issues or bespoke advice, we are here to help.

Automate VAT filings in Latvia via the House of Companies. Our efficient, automated services ensure accurate and timely VAT filing, keeping your business compliant with Latvian and EU tax regulations. Let our experts handle the complexities of VAT so you can focus on growing your business.

The House of Companies offers comprehensive solutions for e-commerce entrepreneurs looking to streamline international sales under Latvian regulations. By optimizing and automating the VAT return process, we help businesses expand into new markets with ease, removing the burden of complex tax compliance.

Our state-of-the-art Document Scanning and Validation service guarantees accuracy and efficiency in managing essential documentation. Additionally, our platform enables real-time VAT reporting, customized to meet the unique requirements of each EU country or product, empowering businesses to navigate international growth confidently.

With our services, you can focus on scaling your business while leaving the complexities of Latvian and EU tax compliance to us!

"Amazon required me to register a local branch to expand to the EU. With HoC, this was a piece of cake, and no accountant was needed!"

Amazon Trader

Amazon Trader"House of Companies made VAT filing so simple and stress-free. Their automated system is a game-changer."

E-commerce Entrepreneur

E-commerce Entrepreneur"The support from HoC's VAT experts has been invaluable. They handle everything, allowing me to focus on my business."

Small Business Owner

Small Business OwnerOur team of European VAT experts is available to provide personalized support tailored to your specific needs. Whether you require assistance with complex VAT issues or bespoke advice, we are here to help.

Our dedicated VAT experts will guide you through the entire automated VAT process, ensuring a smooth and hassle-free experience. From initial setup to ongoing support, we are committed to providing exceptional service.

Our team in Latvia will:

Partnering with our VAT experts at House of Companies allows you to leverage the benefits of automation while receiving personalized support to navigate the intricacies of VAT compliance. Contact us today to explore how our dedicated VAT support can elevate your automated VAT process and drive financial efficiency for your business.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!