Streamline your VAT compliance in Latvia with House of Companies’ comprehensive solutions. Our expertise in Latvian tax regulations ensures accurate and timely VAT submissions, allowing you to focus on growing your business in this Baltic market.

One Control Panel to manage the incorporation of your company and navigate other corporate challenges during your global expansion. Experience the most cost-effective and efficient way to incorporate your company overseas, complete with the tools and community support to ensure your market entry is successful.

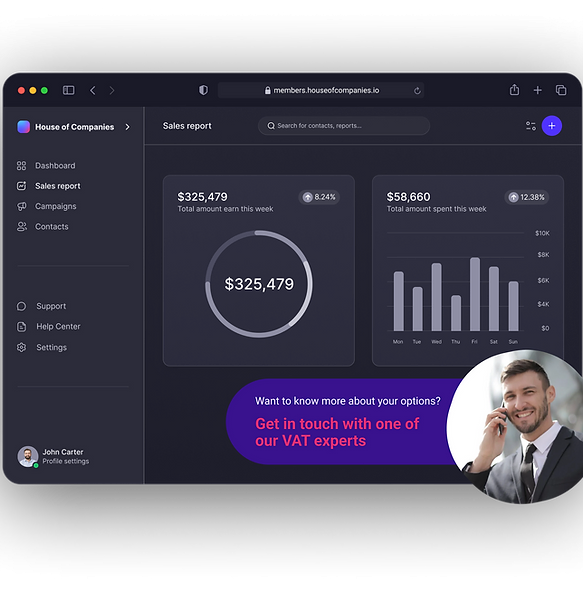

Online portals and entity management tools simplify VAT filings, ensuring compliance and automating return calculations and submissions. These tools help businesses reduce errors, save time, and stay updated with tax laws, making VAT management seamless and efficient.

Once your first VAT return is submitted, you can use Entity Management to further run & grow your company!

“House of Companies made our expansion into Latvia seamless. Their VAT filing service saved us countless hours and potential compliance headaches.”

Baltic Tech Innovations

Baltic Tech Innovations“The expertise of their International Tax Officers is unmatched. They guided us through complex VAT scenarios with ease.”

Global Retail Solutions

Global Retail Solutions“As a non-Latvian speaker, their multi-language support was a game-changer for our VAT compliance.”

European E-commerce Venture

European E-commerce VentureWhile our Entity Management platform simplifies VAT filing, we understand that some situations require personalized expertise. Our International Tax Officers are here to provide full facilitation services.

If you need assistance with your tax return, House of Companies is ready to help. Whether you have existing financial ledgers and VAT analyses or need new ones prepared from scratch, our team ensures that your filings are accurate and compliant.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!