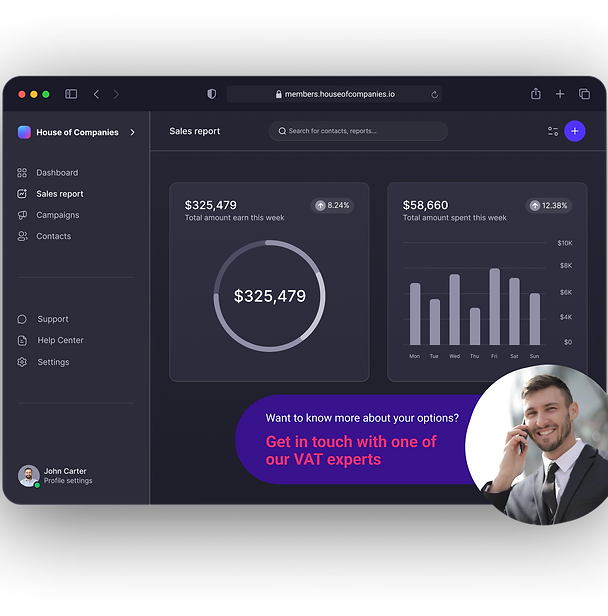

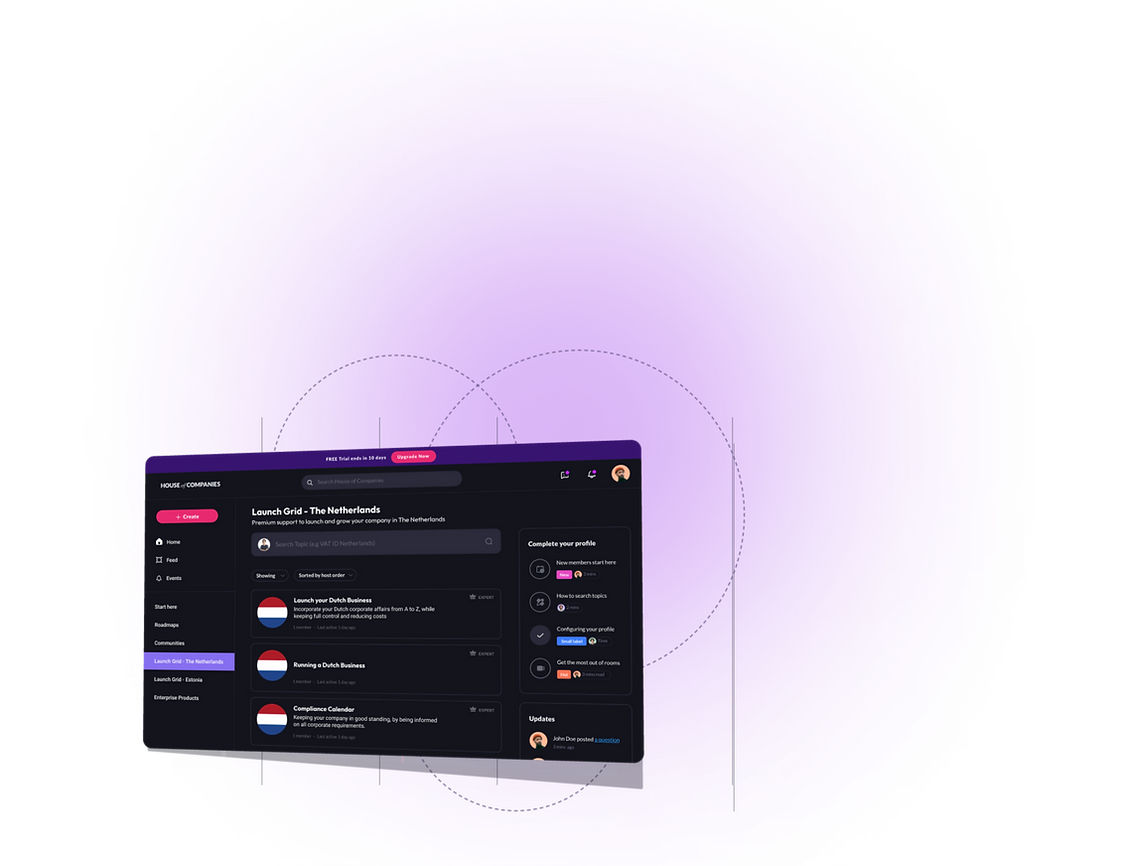

Try out House of Companies' robust platform for Latvian entities to manage their financial data collection and compilation. This platform seamlessly integrates data, documents, and team communication.

Latvian entities can ensure that their financial data is thorough and compliant, providing a solid foundation for the accurate preparation of financial statements. Faster and more efficient than ever!

It's becoming simpler and simpler every day to deliver and process invoices, bank statements, and even agreements (such as your lease). The procedure of submitting your data is made simpler by House of Companies using a single source for all documents, data and reports. You can track our progress, and your profits, realtime!

Your circumstance may actually call for the assistance of a Latvian chartered accountant, despite the ever-expanding nature of tax and accounting playbooks and support. If you need help filing your tax return, House of Companies is here to help.

Preparing Latvian financial statements without an accountant requires a solid understanding of accounting principles, familiarity with Latvian GAAP, and proficiency in using accounting software. Business owners should have basic knowledge of bookkeeping, financial statement formats, and compliance requirements.

It is essential to stay updated with changes in financial regulations and standards. Utilizing resources such as online courses, accounting guides, and software tutorials can help in acquiring the necessary skills.

Gathering and compiling financial data involves collecting all relevant financial documents, including invoices, receipts, bank statements, payroll records, and expense reports. It is crucial to ensure that all transactions are accurately recorded and categorized. Maintaining organized records and backups of all financial documents is essential for accurate financial reporting. Businesses should also keep track of fixed assets, liabilities, and equity to prepare comprehensive financial statements.

In Latvia, businesses are required to prepare three main types of financial statements: the balance sheet, the income statement (profit and loss statement), and the cash flow statement. The balance sheet provides a snapshot of the company's financial position at a specific point in time, showing assets, liabilities, and equity. The income statement summarizes the company's revenues, costs, and expenses over a period, indicating profit or loss. The cash flow statement details cash inflows and outflows from operating, investing, and financing activities. These statements must follow specific formats and templates as prescribed by Latvian GAAP.

Businesses can utilize various data collection methods and tools to gather financial information. Accounting software such as QuickBooks, Xero, and Sage can streamline data collection and ensure accuracy. Manual methods include maintaining physical ledgers and spreadsheets. It is essential to choose a method that suits the business's size and complexity. Automated tools can help in reducing errors and saving time, while manual methods may be suitable for smaller businesses with fewer transactions.

When preparing financial statements, adhere to Latvian Accounting Standards (LAS) and the Law on Annual Reports and Consolidated Annual Reports. Key points for each statement:

List assets, liabilities, and equity as of the reporting date.

Ensure assets equal liabilities plus equity.

Categorize assets and liabilities as current or non-current.

Report revenues, expenses, gains, and losses for the reporting period.

Categorize expenses by nature (e.g., raw materials, staff costs) or function (e.g., cost of sales, administrative expenses).

Report cash inflows and outflows from operating, investing, and financing activities.

Use either the direct or indirect method as per LAS 7.

Refer to the Latvian Accounting Standards Board (LASB) for detailed guidelines and examples.

Leveraging modern technology, the House of Companies portal facilitates the real-time generation and tracking of financial statements. This platform integrates seamlessly with existing financial systems, allowing Latvian SIA entities to maintain accurate, up-to-date records.

The portal supports the automation of the balance sheet and profit and loss account creation, ensuring compliance with Latvian regulations and reducing the risk of misstatements. This tool is invaluable for companies looking to streamline their financial reporting processes.

Ensuring compliance with Latvian Generally Accepted Accounting Principles (GAAP) is critical for Latvian SIA entities to maintain transparency and legal integrity in financial reporting. Latvian GAAP sets a framework that mandates financial information to be understandable, relevant, reliable, and comparable.

Under Latvian law, financial statements must accurately reflect the company’s financial position, presenting the equity at the balance sheet date and the profit for the year fairly and consistently. This includes a comprehensive balance sheet, profit and loss account, and explanatory notes, along with specific valuation and disclosure requirements.

Failure to comply with Latvian GAAP can result in significant consequences for a Latvian SIA, such as the rejection of financial statements by auditors, legal penalties, or financial discrepancies reported to authorities. This can impact the company’s reputation and its ability to secure future financing or partnerships.

Directors of a Latvian SIA are responsible for ensuring that financial statements comply with Latvian GAAP. If directors fail in their duty of care, they may be held personally liable for any resultant damages to the company. Directors must act with due diligence and attention to avoid personal liability.

In Latvia, the role of a chartered accountant is crucial in preparing financial statements and ensuring compliance with Latvian GAAP. These professionals, governed by strict regulations, provide an independent assessment of financial reports, ensuring they present a true and fair view of the company’s financial health.

External auditing is crucial for ensuring the accuracy, transparency, and compliance of financial statements. In Latvia, it provides a credible, independent review of a company’s financial health, enhancing trust among investors, stakeholders, and regulatory authorities. This credibility is especially valuable when seeking new investments or financing.

In Latvia, external audits are often legally required for businesses that meet specific revenue thresholds or other criteria. By undergoing an external audit, companies ensure they comply with local laws, including those set by the Latvian Register of Enterprises and Tax Administration, helping to avoid potential penalties for non-compliance.

External audits help identify financial risks and opportunities. Auditors examine financial records to spot inefficiencies, fraudulent activity, or mismanagement. This helps businesses take corrective actions early, while also uncovering potential savings or areas for growth.

An audit also enhances internal controls by providing an independent assessment of the company’s financial practices. Auditors often suggest improvements to safeguard assets and ensure accurate reporting, reducing the likelihood of financial mismanagement or fraud.

External auditing increases stakeholder confidence, especially for companies seeking external funding or planning major financial decisions. Independent audits demonstrate financial stability and transparency, making businesses more attractive to investors and lenders.

Lastly, external audits strengthen corporate governance by ensuring that management is acting in the best interest of shareholders and stakeholders. Regular audits help businesses demonstrate accountability and transparency, which are vital for maintaining regulatory compliance and trust.

To ensure regulatory compliance and transparency, Latvian SIA entities must file their annual financial statements with the Latvian Register of Enterprises (LUR) within specific deadlines.

The board of directors must prepare the annual accounts within five months after the financial year ends. These accounts are then presented to the shareholders, who have two months to adopt them. Once adopted, the financial statements must be filed with the Latvian Register of Enterprises within eight days.

In exceptional circumstances, shareholders can grant an extension to the board for preparing the financial statements. However, even if the accounts are not adopted within the set time frame, unadopted accounts must still be filed within the required deadlines.

Corporate tax return filing involves calculating the CIT liability, completing the required forms, and submitting them to the Latvian Tax Office. The calculation includes determining taxable income, applying the appropriate tax rate, and accounting for any deductions or credits. Payment of CIT must be made within specified deadlines to avoid interest and penalties. Businesses should be aware of common pitfalls, such as incorrect calculations or missed deadlines, and take steps to ensure compliance.

Corporate tax return filing involves calculating the CIT liability, completing the required forms, and submitting them to the Latvian Tax Office. The calculation includes determining taxable income, applying the appropriate tax rate, and accounting for any deductions or credits. Payment of CIT must be made within specified deadlines to avoid interest and penalties. Businesses should be aware of common pitfalls, such as incorrect calculations or missed deadlines, and take steps to ensure compliance.

Compliance with corporate tax filing requirements is essential to avoid penalties and legal issues. The Latvian Tax Office may conduct audits to verify the accuracy of tax returns and ensure compliance with regulations. Businesses should maintain accurate records, provide necessary documentation, and cooperate with auditors. Filing methods include electronic filing options, which offer convenience and efficiency. Extensions for corporate tax returns may be granted in certain circumstances, and businesses should understand the process for requesting extensions.

Avoiding double taxation is crucial for businesses operating internationally. Strategies include utilizing tax treaties, claiming foreign tax credits, and structuring business operations to minimize tax liability. Businesses should understand the tax laws in each jurisdiction they operate in and seek professional advice to navigate complex tax regulations. Proper planning and compliance with international tax laws can help businesses avoid double taxation and optimize their tax position.

[1] - https://www.houseofcompanies.in/

[2] - https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/audit/deloitte-nl-audit-annual-accounts-in-the-netherlands-2019.pdf

[3] - https://theaccountingjournal.com/netherlands/financial-reporting-in-the-netherlands/

[4] - https://online.hbs.edu/blog/post/how-to-prepare-an-income-statement

[5] - https://www.youtube.com/watch?v=aRL1MDYFMZ4

[6] - https://www.tax-consultants-international.com/publications/accounting-and-audit-requirements-in-the-netherlands

[7] - https://www.bnnlegal.nl/en/services/insolvency-law-and-bankruptcy/directors-liability-in-the-netherlands/

[8] - https://www.linkedin.com/pulse/7-reasons-conduct-external-audit-uae-atif-iftikhar

[9] - https://www.nba.nl/opleiding/foreign-auditors/ra-qualifications/the-dutch-educational-system-for-register-accountants/

[10] - https://www.kvk.nl/en/filing/when-do-i-have-to-file-my-annual-accounts/

[11] - https://www.kvk.nl/en/filing/am-i-required-to-file-annual-reports-and-accounts/

[12] - https://taxsummaries.pwc.com/netherlands/corporate/tax-administration

[13] - https://business.gov.nl/regulation/corporate-income-tax/

[14] - https://business.gov.nl/finance-and-taxes/business-taxes/filing-tax-returns/filing-your-corporate-tax-return-vpb-in-the-netherlands/

Try out the Portal of House of Companies to deal with your Annual Financial Statement requirements in Latvia, at a fixed fee, with minimal involvement of an accountant. Simplifying this process through advanced technology not only bolsters accuracy but also frees valuable resources, allowing businesses to focus on core activities that drive growth and profitability.

"I expected to take about 2 quarters to generate turnover in Germany. Luckily I didn’t have to spend any money on an accountant in the meantime."

Global Talent Recruiter

Global Talent Recruiter"My Indian accountant drafts my VAT Reports, and submits the return using Entity Management!"

Spice & Herbs Export

Spice & Herbs Export"The practical know-how in Entity Management made me comfortable to get more involved in my own tax filing! And it worked!"

IT firm

IT firmFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!