House of Companies is excited to offer clients in Latvia cutting-edge accounting and bookkeeping services, ensuring that all financial requirements are met efficiently and effectively.

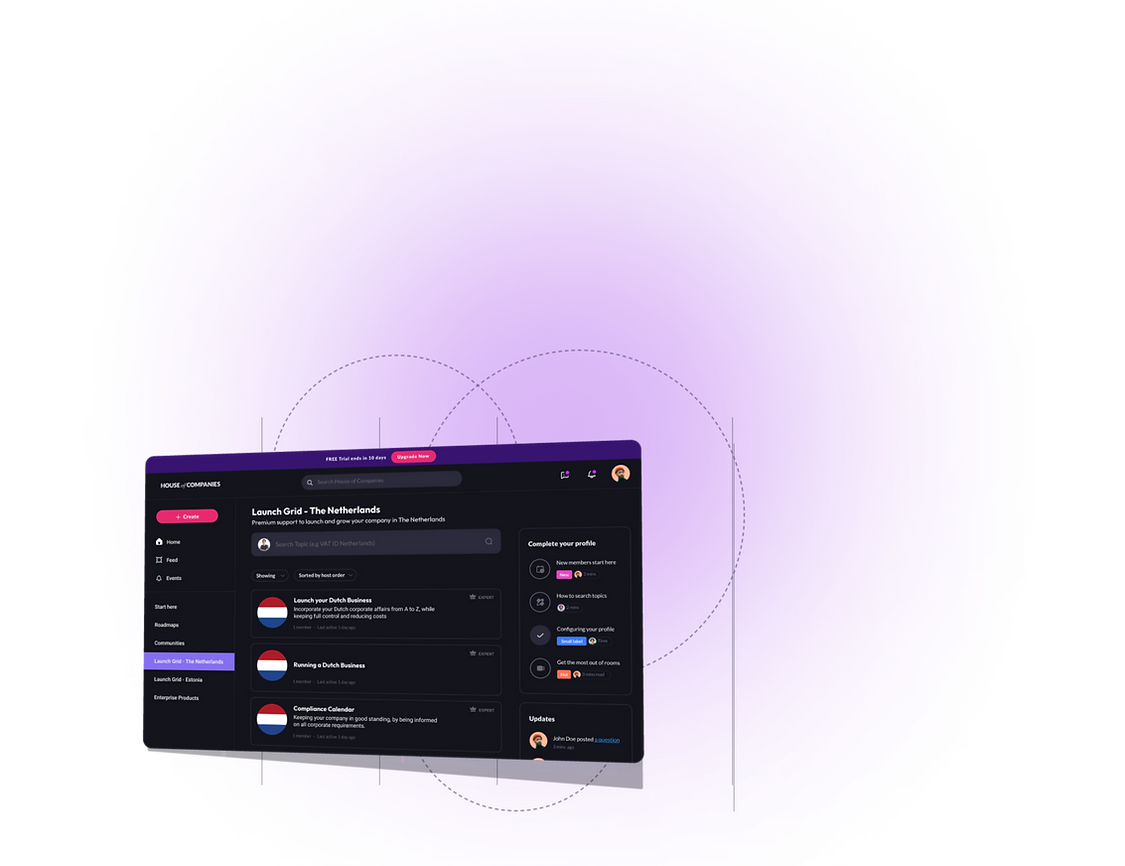

We provides an extensive range of entity management services, including bookkeeping, tax filing, and financial reporting, tailored to the needs of both local and international companies. These services enhance operational efficiency through a real-time dashboard that tracks compliance and financial activities, reducing the reliance on external accountants.

Automate your OSS VAT filings for e-commerce and imports.

Automate financial year-end and statement preparation in Latvia

Simplify VAT filing for EU and

non-EU clients in

Latvia

Expand and manage your business in Latvia effortlessly

For example, a local startup can benefit from automated tax compliance, while an international firm can effectively manage its Latvian branch's financial close process, ensuring financial transparency and accuracy.

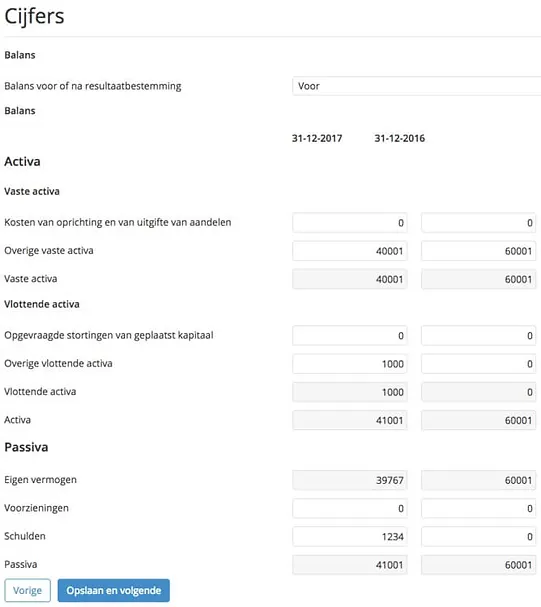

Latvia's accounting framework is governed by the Annual Accounts and Consolidated Annual Accounts Law, which aligns with the EU Accounting Directive 2013/34/EU. The regulations are supplemented by Latvian Accounting Standards (LAS) issued by the Ministry of Finance and the optional adoption of International Financial Reporting Standards (IFRS) for certain entities.

Companies listed on regulated markets must comply with additional financial reporting requirements under Latvian securities laws. Annual financial statements must include a management report, financial statements, auditor’s report (if required), and supplementary information mandated by the law. These documents must be filed with the Latvian Commercial Register within three months of the financial year-end.

Substance (Permanent Establishment):

Without Substance (Non-Resident):

Having substance in Latvia provides credibility and access to tax treaty benefits but entails higher administrative and compliance costs.

Non-resident businesses in Latvia can choose from various legal structures:

Key considerations include tax obligations, administrative complexity, and compliance requirements.

Establishing a branch office in Latvia requires careful consideration of accounting requirements. Profits generated by the branch are subject to Latvian Corporate Income Tax (CIT), ensuring compliance with the country’s tax framework. Additionally, transfer pricing rules apply to all transactions between the branch and its parent company, requiring detailed documentation to demonstrate compliance with arm’s-length standards.

Financial reporting obligations include maintaining accurate records specific to the branch’s activities, often supplemented by the parent company’s financial statements to provide a comprehensive overview. Moreover, if the branch conducts taxable activities, VAT registration is mandatory, ensuring the proper collection and remittance of VAT on transactions. Non-compliance in these areas can result in fines and reputational risks.

Businesses operating in Latvia must register with the Latvian State Revenue Service (SRS) before commencing any taxable activities. This registration ensures compliance with corporate tax obligations and avoids penalties for late registration, which can include fines and backdated taxes. Proper registration is a critical step for businesses to operate legally in Latvia.

Businesses engaged in VAT-taxable activities in Latvia are required to register for VAT if their annual turnover exceeds €40,000. This threshold includes most goods and services but may vary for certain transactions, such as intra-EU trade.

VAT registration ensures compliance with Latvia's tax laws and enables businesses to reclaim input VAT on qualifying purchases. Once registered, entities must submit regular VAT returns to the SRS, detailing taxable and exempt supplies. The standard VAT rate in Latvia is 21%, with reduced rates applicable to specific goods and services.

Failing to comply with VAT regulations can result in significant penalties, including financial fines and operational restrictions.

Resident companies are taxed at a flat 20% corporate income tax rate on distributed profits. Retained earnings are tax-deferred. Filing deadlines are tied to annual financial statements, with penalties for late submissions.

Non-resident entities must maintain proper accounting records under Latvian Generally Accepted Accounting Principles (Latvian GAAP) or IFRS. Simplified reporting is available for smaller businesses.

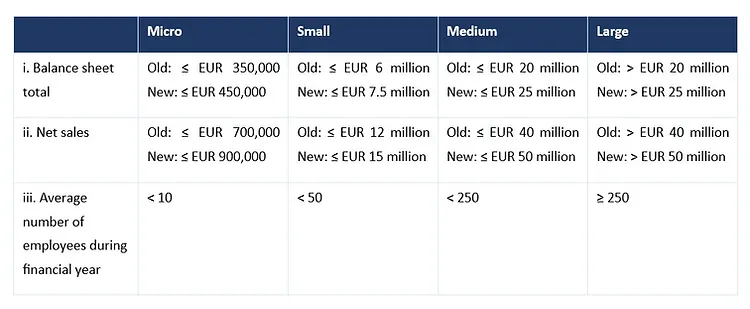

Financial statements must include:

These statements must comply with local GAAP or IFRS, as applicable.

In Latvia, companies that belong to a group meeting specific size thresholds must prepare consolidated financial statements. These thresholds typically relate to annual turnover, total assets, and the number of employees within the group. The goal of this requirement is to provide a clear overview of the group’s financial position and performance.

However, smaller groups may qualify for exemptions, allowing them to avoid the consolidation requirement. Businesses should assess their group structure against the established thresholds to determine if they are subject to this obligation. Non-compliance can lead to regulatory scrutiny and penalties.

Audits are mandatory for companies operating in Latvia that exceed certain size thresholds or function within regulated industries such as finance or insurance. The audit process involves a detailed review of financial statements to ensure they present an accurate and compliant view of the company's financial health.

The thresholds are based on criteria such as turnover, assets, and workforce size, and smaller entities may be exempt. Engaging a certified auditor is essential for businesses subject to audit requirements, as accurate financial reporting builds credibility with stakeholders and helps avoid potential penalties or reputational damage.

Under Latvian law, most corporate entities are required to prepare financial statements in accordance with their statutes, which are vital for legal compliance and corporate governance. These financial statements also play a key role in determining the taxable base, although tax laws have independent rules.

The content of the financial statements varies based on the company’s size and publication requirements but typically includes at least a balance sheet, profit and loss account, and notes. Financial statements must accurately reflect the company's financial position, and any changes in accounting principles must be disclosed in the notes. Parent companies generally need to include financial data from their subsidiaries and group companies in consolidated statements, though exceptions apply, such as when a subsidiary meets criteria for being a small company or when financial data is already included in a parent company’s consolidated financial statements per the EU Directive.

In Latvia, medium and large companies, as well as those applying international financial reporting standards (IFRS), are legally required to have their annual report audited by an independent, qualified auditor. The audit report must confirm that the financial statements are prepared in accordance with accepted accounting principles and accurately represent the company’s financial status for the year.

In Latvia, businesses, both resident and non-resident, are required to maintain accurate financial records to comply with local tax laws and accounting standards. Online bookkeeping services offer an efficient solution for businesses of all sizes to meet these requirements, while simplifying their financial management.

To ensure accuracy and compliance, it is essential to find bookkeeping experts familiar with Latvia’s complex tax regulations. Experienced professionals can provide advice on structuring financial reports, adhering to deadlines, and understanding the nuances of Latvian tax laws. These experts can also offer guidance on the optimal use of online bookkeeping systems to improve efficiency.

The pricing for online bookkeeping services in Latvia can vary depending on the size and complexity of your business. Typically, service providers offer different pricing models, such as:

Factors influencing pricing include the volume of transactions, the number of employees, and the complexity of financial reporting required for your business.

Latvian online bookkeeping services provide various tools and features tailored to different business needs:

For both local businesses and international companies with operations in Latvia, online bookkeeping services offer an efficient and cost-effective way to manage financial obligations and ensure compliance with the country’s accounting and tax regulations.

Industry-specific bookkeepers bring a wealth of knowledge that extends beyond basic accounting principles. They possess a deep understanding of sector-specific regulations, tax implications, and financial best practices. This expertise allows them to:

Their ability to work with a wide range of stakeholders, from customers to senior management, makes them adept at managing complex relationships within the business ecosystem.

Industry-specific bookkeeping services in Latvia offer various pricing models based on business needs, sector complexity, and required services. Here are the most common models:

Hourly Rate Pricing

Businesses pay for the actual time spent on bookkeeping tasks. Rates range from €25 to €80 per hour, depending on the industry.

Fixed Monthly Fees

A set monthly fee for ongoing bookkeeping services. Fees typically range from €300 to €1,500 per month, depending on the industry and scope.

Per-Transaction Pricing

Businesses pay per transaction (e.g., invoicing, payroll). Fees typically range from €1 to €10 per transaction.

Tiered Pricing

Offers different service packages, from basic bookkeeping to comprehensive financial management. Packages range from €200 to €3,000 per month.

Project-Based Pricing

A one-time fee for specific projects like system setup or audits. Fees range from €500 to €5,000.

Value-Based Pricing

Fees are based on the value the bookkeeper brings to the business. Costs typically range from €1,000 to €5,000+ per month.

Virtual offices offer registered addresses, mail handling, and call forwarding, providing cost-effective solutions for businesses. Non-residents can establish a virtual office remotely while complying with Latvian laws.

Pricing: Virtual office services range from basic packages to premium offerings with access to professional meeting spaces and administrative support.

Virtual bookkeepers in Latvia bring a wealth of experience in accounting principles and cloud-based software. They manage balance sheets, income statements, and financial reports, while also supporting key stakeholders, from customers to management. Their extensive training ensures accurate and compliant financial services aligned with Latvian regulations.

Pricing for virtual bookkeeping assistants varies based on experience and task complexity. Rates typically range from EUR 0.79 to EUR 78.56 per hour, with some services offering monthly subscriptions for consistent support. Many Latvian businesses opt for fixed or tiered pricing plans to fit their budgets.

Key features include:

Latvian companies must ensure financial statements are accurate, compliant with local regulations, and include reports such as balance sheets and profit & loss accounts. Be sure to assess whether you need help with:

When considering virtual bookkeeping services, assess the value beyond cost:

Virtual bookkeeping assistants provide a cost-effective solution for Latvian businesses, helping them focus on growth while ensuring compliance and efficiency.

Latvia offers a range of accounting services designed to support both EU and non-EU businesses. These services ensure compliance with local laws, streamline financial management, and help businesses navigate the complexities of international tax systems. Some of the most popular accounting services in Latvia include:

For both EU and non-EU companies, accountants assist in managing VAT registration, filing VAT returns, and handling cross-border VAT issues.

Many Latvian accounting firms offer payroll management, including calculating salaries, tax deductions, and social security contributions for employees.

Accurate and up-to-date bookkeeping ensures businesses in Latvia stay organized with transaction recording, reconciliations, and financial reporting.

Many firms offer advice on the best corporate structure for businesses, including those seeking to expand into the Latvian market or manage international operations.

"We expanded our operations into Latvia and House of Companies helped us with VAT registration and tax filings. Their service was fast, efficient, and cost-effective."

Global Talent Recruiter

Global Talent Recruiter"With House of Companies, I don’t worry about VAT returns. They take care of everything, including compliance with both EU and Latvian tax regulations."

Spice & Herbs Export

Spice & Herbs Export"The practical know-how in Entity Management provided by House of Companies made me comfortable to get more involved in my own tax filing, and it worked perfectly!"

IT Firm

IT FirmYour circumstance may actually call for the assistance of a local tax professional, despite the ever-expanding nature of tax and accounting regulations. A local accountant may be required by law in certain countries.

If you need help filing your tax return, House of Companies is here to help.

You can either send us your existing ledgers and VAT Analysis, or instruct us to draw up new ones from scratch.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!